Stellar’s XLM looks poised for a bullish breakout this month, with technical indicators flashing green.

The altcoin has formed a classic bull flag pattern on the daily chart, a trend often preceding an extended upward move. If the setup holds, XLM could be on track for a move toward the $0.67 mark.

XLM Prepares for Next Push

A bull flag pattern is formed after a strong price rally when the asset enters a brief period of consolidation, during which it trades within a horizontal channel.

This phase resembles a “flag” on the chart and suggests that buyers are taking a breather before pushing prices higher again. The pattern is considered a bullish continuation, meaning it is likely to result in another upward leg once the consolidation ends and a breakout occurs.

XLM’s recent price action follows this structure. Between July 8 and July 14, the altcoin surged by 84%, marking a strong upward move (forming a flagpole). Since then, XLM has entered a consolidation phase, trading within a horizontal channel on the daily chart.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XLM Bull Flag Pattern. Source: TradingView

XLM Bull Flag Pattern. Source: TradingViewThis formation suggests that bulls are not backing down, but rather regrouping. The consolidation reflects a healthy cooldown after the uptick, allowing the market to rebuild bullish sentiment.

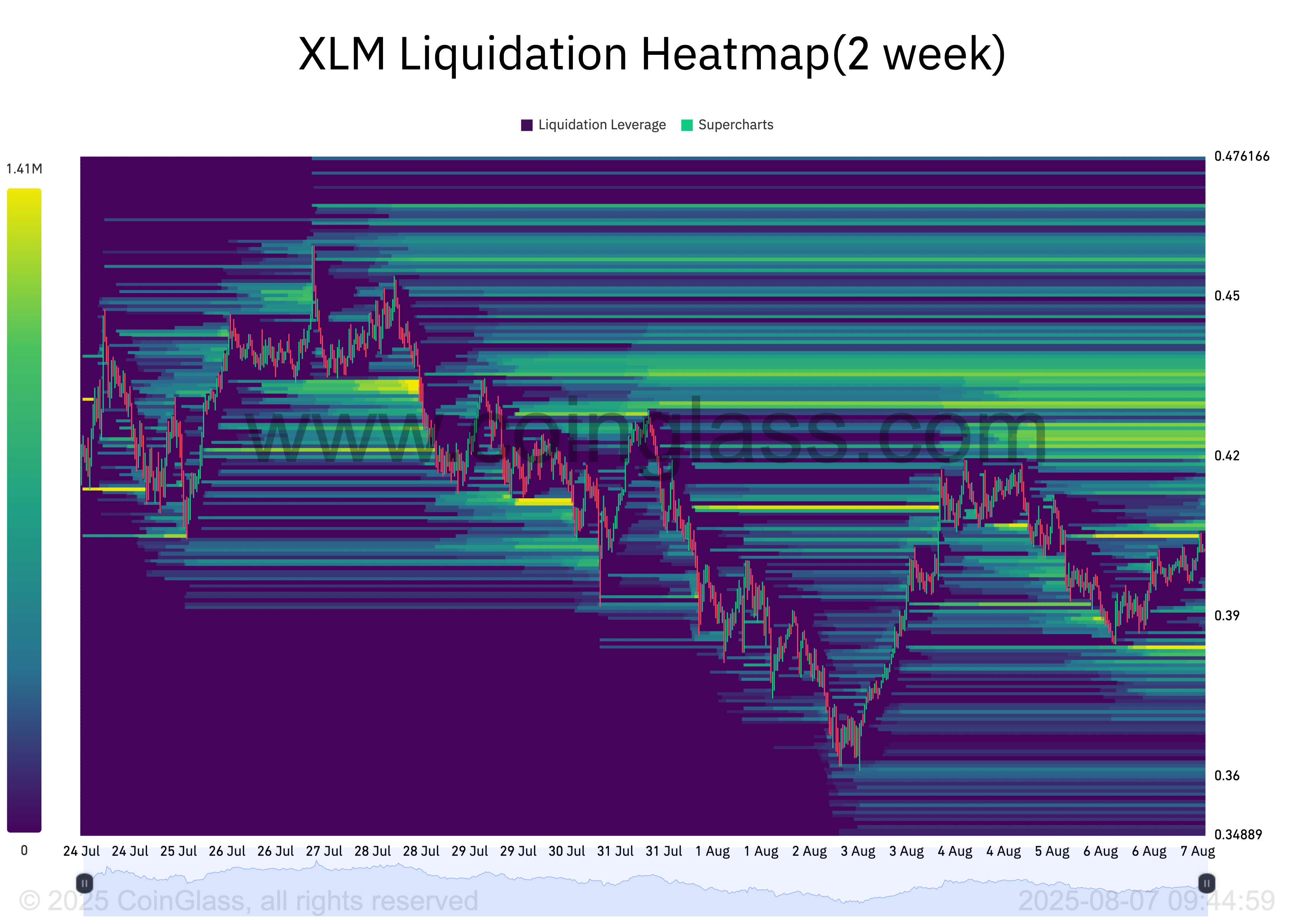

Moreover, XLM’s liquidation heatmap shows a significant concentration of liquidity at the $0.42 price zone. This cluster sits above XLM’s current trading range, further strengthening the case for a potential upward move.

XLM Liquidation Heatmap. Source: Coinglass

XLM Liquidation Heatmap. Source: CoinglassTraders use liquidity heatmaps to visualize where large numbers of stop-losses, take-profits, and liquidation levels are positioned. These clusters act as magnets for price, especially in highly leveraged markets.

For XLM, the visible cluster near $0.42 hints at a potential move toward that price point. This could drive momentum and serve as the first step toward a broader price surge.

Can XLM Hold the Line?

Generally, when a bull flag pattern forms, it signals that after a brief period of consolidation, the asset is likely to continue its prior uptrend. The expected move following a breakout is often equal in height to the initial rally (the “flagpole”).

If this technical setup holds, XLM could be on track for a rally toward $0.67, aligning with the measured target.

XLM Price Analysis. Source: TradingView

XLM Price Analysis. Source: TradingViewHowever, if the price fails to hold the breaks below the horizontal consolidation channel, it would invalidate the bullish pattern. In that scenario, downside pressure could increase, dragging XLM below the $0.38 level.

The post Why August Could Be Big for XLM: Two Factors to Watch appeared first on BeInCrypto.

2 months ago

37

2 months ago

37

English (US) ·

English (US) ·