Are Ethereum’s Glory Days Over?

“Hey.

Yeah, you.

Come here for a second. Sit down. Pry your eyes away from the charts for just a moment. I know…I know, it’s hard. But I promise that the markets will be fine without your constant attention.

I want to ask you a question…is this your first bull run?”

Maybe it is, and maybe it isn’t. But the question that seems to be on everyone’s lips is: Ethereum, why you not move?

This article was originally published on my Substack

I am probably not the only one who feels some deja vu about this. It seems like anyone who’s been through a few cycles knows that Bitcoin always outperforms everything in the beginning. Everyone panics, switches all their money from ETH to BTC at the last moment, and then watches with unabashed horror as ETH rallies while they miss both. Classic.

It’s just a law of the universe. Like how modern cinematic brands will always make one too many sequels before they call it quits and that the only people who hate Lululemon are those who have never actually tried on their clothes.

The fundamental question I aim to explore in this article is:

- Is Bitcoin’s early run simply the repetition of a historical pattern?

- Or is it because Bitcoin is stepping into its role as a risk-off asset while ETH remains a risk-on asset?

- Or is Bitcoin just still doing normal Bitcoin things, and Ethereum actually losing its edge?

To fully answer this question requires a deep dive into Ethereum, the technology, its competitors, and the changing narrative around ETH, but I’m leaving this article a bit more brief, and I’ll cover some of those other questions later.

In this article, I cover:

- Has BTC historically outperformed ETH early on during bull runs?

- How are ETFs changing things?

- What about the macro market conditions?

- My conclusions

Lessons From Historical Bull Runs: Does ETH Lag Behind BTC?

So, is it actually true that BTC outperforms ETH at the beginning of bull runs? The answer? Yeah…kind of.

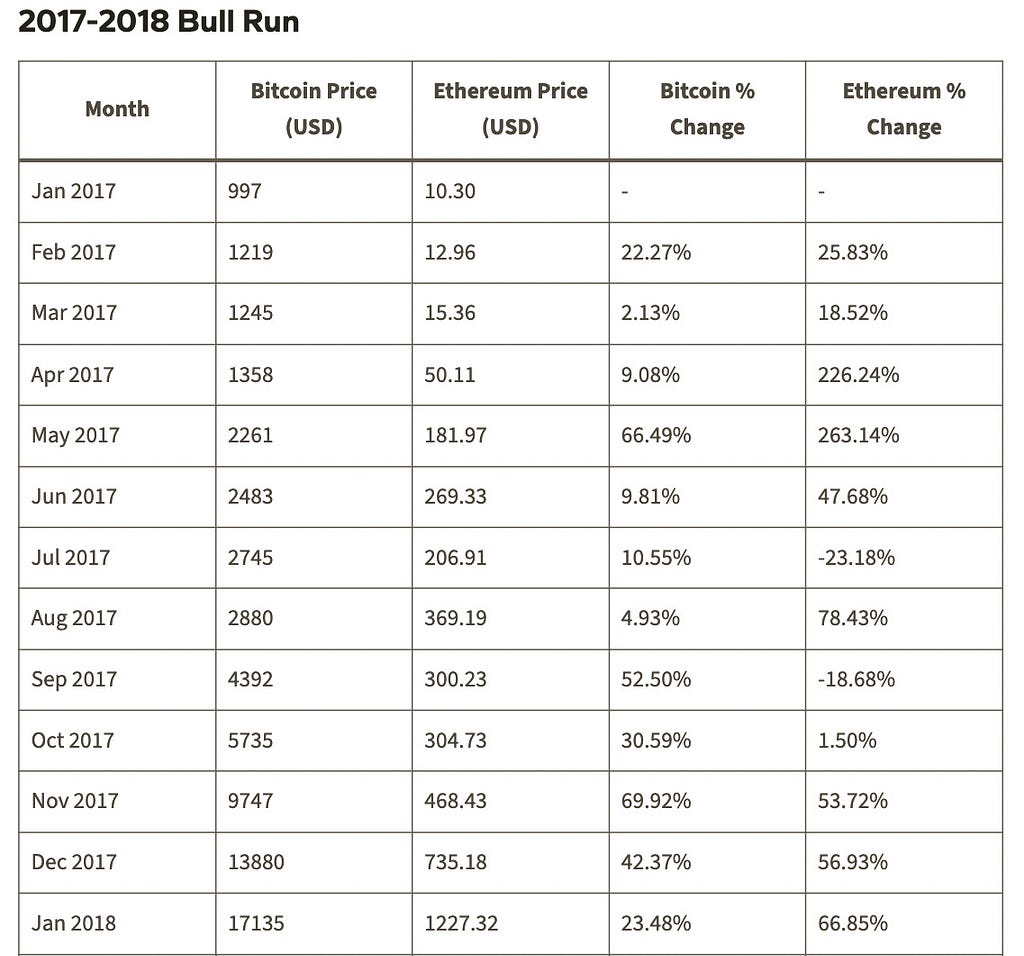

During the 2017–2018 bull run, it really depends on how you look at the data. It is true that BTC soared to $19,764 in December 2017, only for ETH to peak at $1,448 nearly a month later in January 2018. But, in the early part of 2017, ETH clearly outperformed BTC, although a lot of that can be chalked up to how early it was for Ethereum — it was about $10 per ETH at the beginning of the year.

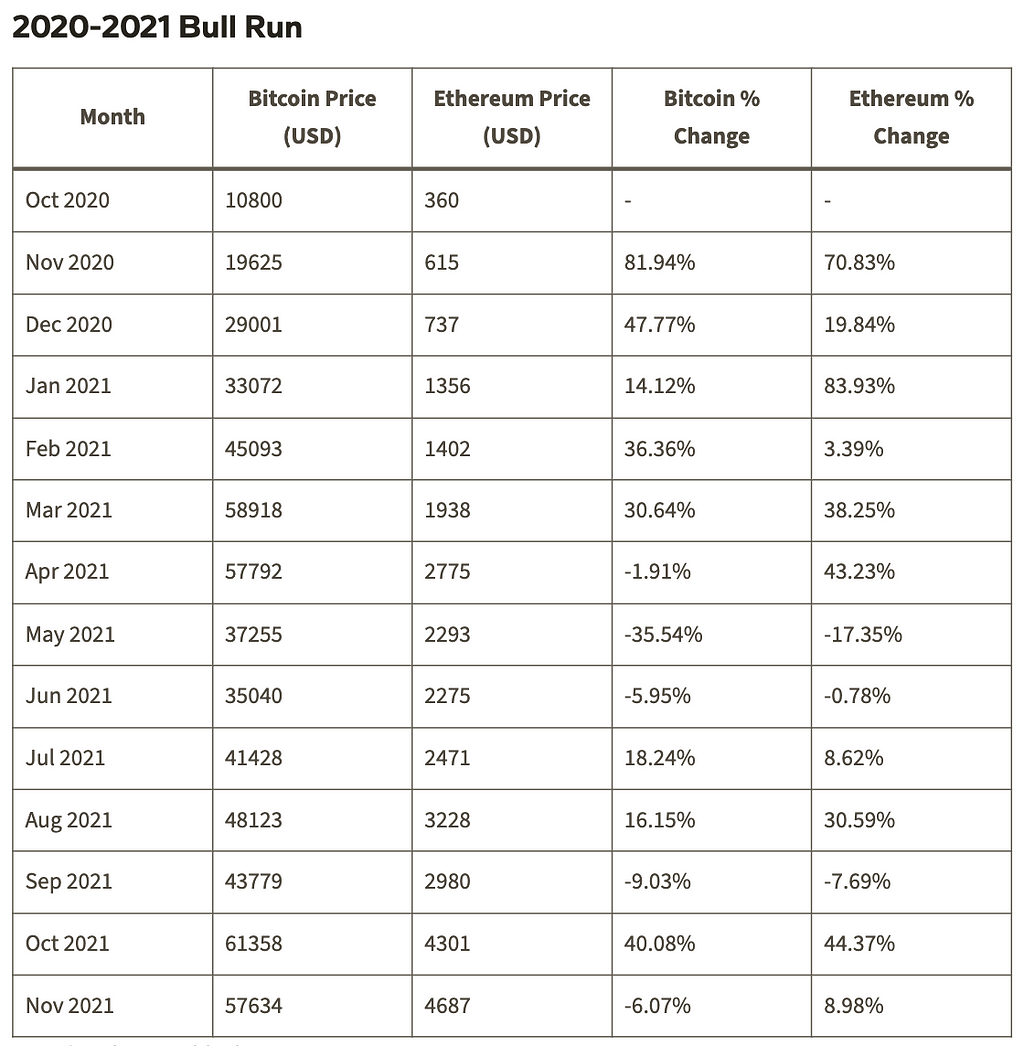

The 2020–2021 bull market was a bit different. Both BTC and ETH hit their all-time highs on November 10th, 2021, with BTC reaching $69,000 (you can’t make this stuff up) and ETH hitting $4,878. Although Ethereum’s percentage gains (1,255%) outperformed Bitcoin’s (539%) during the bull market, its earlier rally was slower, reflecting the typical pattern of capital rotation into altcoins.

So, it’s not a closed cut trend, but it’s also clear that it’s not necessarily a cause for concern just because BTC is rising while ETH sits stagnant.

In general, the narrative goes that BTC is the first mover because investors are generally more comfortable investing in BTC — considering it’s the oldest, has the largest market cap, and has the most name recognition. As money floods into the crypto markets via BTC, positive overall sentiment grows, more people get involved and learn about alts like ETH (although I feel like, at this point, ETH isn’t really an “alt”), the cycle of FOMO drives people from BTC to ETH and then to small cap coins, NFTs, and whatever else the hypers are peddling.

Also, I can almost guarantee that in two months, everyone is going to feel pretty good about Ethereum. It just seems that the narratives are so reactive to short term price fluctuations. I guess that’s the fourth law of the universe.

Has ETH Historically Lagged Behind BTC? TL;DR

The short answer is kind of. It’s not a strict pattern, but the numbers certainly say that just because BTC is moving first, doesn’t mean you should be concerned about your ETH.

If you hold ETH, history is on your side. Hold tight, and do something with your ETH in the meantime.

But hold on…maybe this time is different? Maybe there are other factors that weren’t there in the past that are changing the trend?

ETF Analysis: Why Are Bitcoin ETFs Outperforming Ethereum ETFs?

One of these differences is that we’ve got crypto ETFs now. Sexy.

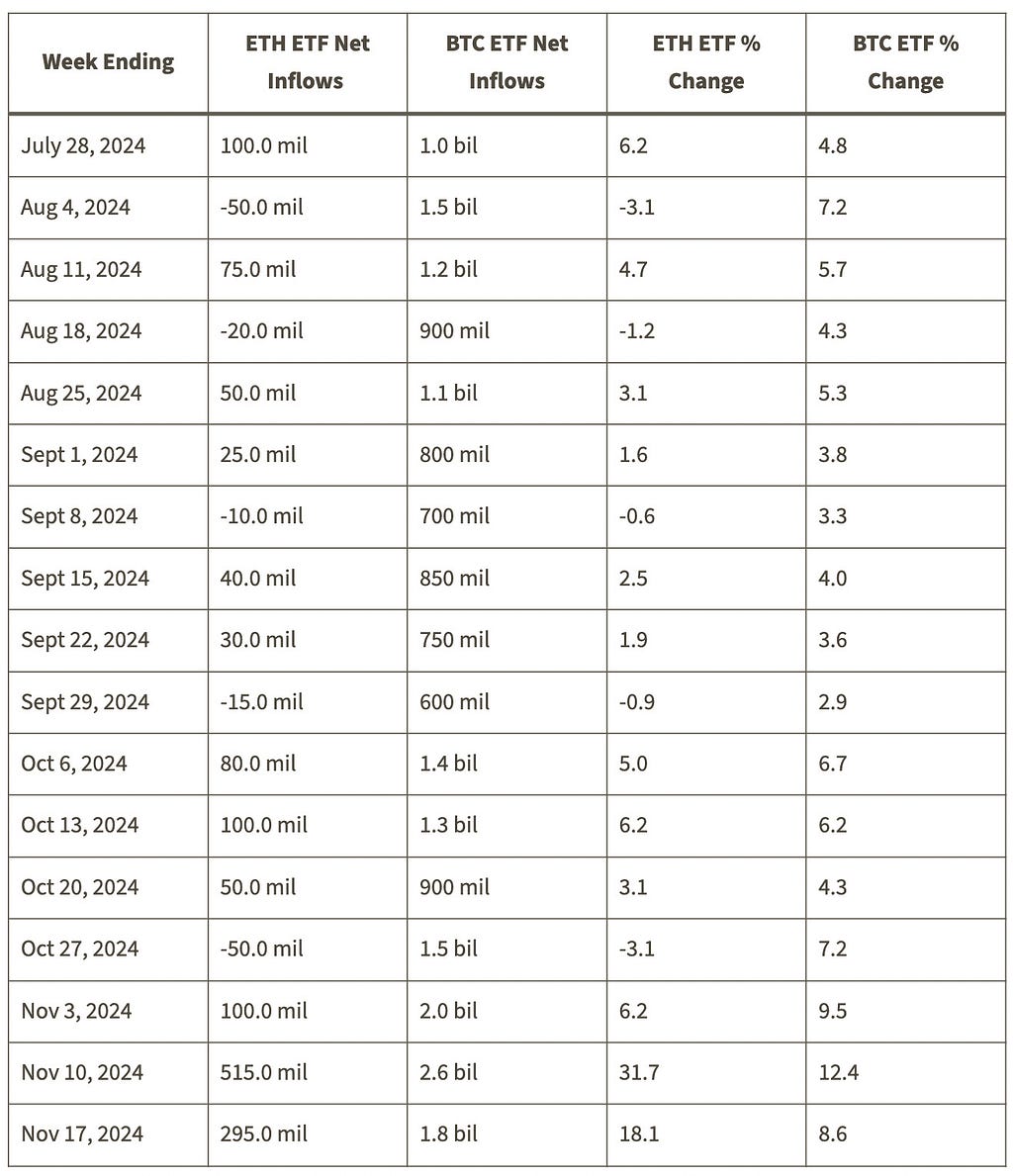

Bitcoin ETFs have greatly outperformed Ethereum ETFs since their inception (Spot BTC ETF came online in January of 2024, and the ETH ETF in July 2024).

Why is that?

I’d say that there are three main reasons:

1. Investors understand BTC better

Bitcoins’ narrative is both clearer and more clearly aligns with current global geopolitical and economic trends. I’ll discuss this more below, but BTC is digital gold and is generally considered a risk-off asset, while ETH is risk-on.

Simply put, when your aunt asks you about crypto, they usually say Bitcoin, not Ethereum, and certainly not Peanut the Squirrel. The day we have a PNUT ETF is the day I retire from crypto.

Furthermore, I imagine that ETH still remains largely a mystery to institutional investors. Ethereum’s broader utility in DeFi, NFTs, and smart contracts is harder to explain to traditional investors. Ultimately, ETH is aiming to be digital money on top of a digital, decentralized financial system. That’s a harder pitch than digital gold, and there are a lot more pieces that have to be in place to make it happen.

2. Bitcoin has more regulatory clarity

Bitcoin does have more regulatory clarity because Ethereum is a more complicated product. The big issue here is that without regulatory clarity, ETH ETFs can’t benefit from ETH’s native staking. That’s a huge advantage that ETH offers and a huge part of its long term value that’s simply not being reflected in its ETF.

However, I fully expect this to be temporary. An ETH ETF with native staking is coming.

3. A Bitcoin short squeeze

With a lot of BTC being purchased by these ETFs, the price was pushed up pretty dramatically. As crypto short sellers (those betting against BTC) face liquidation, they’re forced to buy more BTC to cover their position, further pushing the price up.

Obviously, if ETH started to rally, we’d see a similar situation.

Better Days Ahead For ETH ETFs?

The tides do seem to be shifting. Positive total inflows for the ETH ETF reached 241 million (as of four days ago). You can see this reflected in the chart below. But obviously, there’s still substantially more interest in the BTC ETF than the ETH one.

The Impact of the ETFs: TL;DR

The crux of the evidence here is that BTC is more appealing to institutional investors.

However, despite the fact that the BTC ETF is outperforming the ETH ETF, I think that BTC and ETH will behave similarly to their historical pattern, ETF or no ETF.

The factors making the BTC ETF more attractive are the same factors that made BTC more attractive in the past and caused it to lead the bull run (i.e., name recognition, regulatory clarity, easier to understand). It’s just that the market potential is much larger as the doors are open to institutional investors.

Also, the ETH ETF has begun to do better as of the last week. So, my thesis might be correct quite soon.

Leading the Bull Run charge…see what I did there?

Macro Market Conditions

So here’s the thing that I actually think is different: the macro market conditions and how suitable they are for a monumental Bitcoin run.

Here’s the thing. Bitcoin’s timing is almost too good to be true. It’s almost so perfect that it either makes me believe in a conspiracy theory or in God.

How is it that we have an inflation-proof, digital, fungible asset that just surpassed the market cap of silver, while MMT economic policies are threatening the West with unprecedented inflation and challenging the dollar as the global reserve asset?

Add in the results of years of international policies of appeasement and the rise of the China, Russia, Iran, and North Korea block, and you have a strong case for why the dollar won’t continue to be the main thing on central bank reserve asset sheets.

I think people are catching on. The real explosion will be when/if enough countries recognize that enough other countries are adding BTC to their balance sheets and don’t want to be left out. That’s where things get very, very interesting.

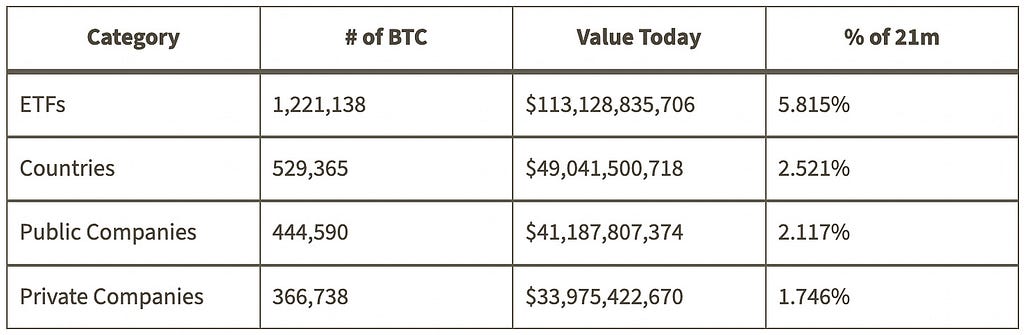

I don’t think we’re there yet. Only 7 countries have BTC, and other than Bhutan and El Salvador, most of those acquisitions came through legal seizures. But maybe countries are buying and keeping it anonymous? I mean, I would if I were them. But assuming we’re not there yet, if this narrative catches on, this is how BTC could really outpace ETH.

And companies are certainly catching on:

Risk-On vs. Risk-Off Assets

But, even if we don’t see a massive run on Bitcoin driven by central banks and companies, Bitcoin is better situated for the global economic situation than Ethereum.

Bitcoin’s narrative as a hedge against inflation positions it well during periods of tightening monetary policy, as it is increasingly seen as a “risk-off” asset, similar to gold. Ethereum, by contrast, functions more as a “risk-on” asset due to its reliance on speculative activity within its ecosystem.

This is critical.

Macro Conditions TL;DR

This narrative I presented above is the main reason that I have chosen to keep about half of my crypto investments in BTC (although I know many more who choose to be all in on Bitcoin for these reasons).

Ultimately, the narrative of Bitcoin as digital gold and as a reserve asset is gaining steam.

Conclusion: Bitcoin or Ethereum?

If you’re still with me, thank you. Everyone tells me I waste too many words. Maybe they’re right. But I also think people appreciate knowing there’s actually a human behind this keyboard. And god, we’re all just monkeys messing around, so let me have some fun with it.

I think that ETH is going to be just fine, and I expect the market to play out similarly to how it has in the past. I imagine that this BTC price explosion will soon be followed by a similar increase of ETH toward its all-time highs. Then we’ll probably see the continuation of the meme coin hype, some return of ETH NFTs, and some things that no one is expecting (wish I knew. I’ll tell you when I do).

However, I think that we are also seeing Bitcoin stepping a bit more into its destined role as the ultimate risk-off asset. I think we’re going to have to get used to the ETH/BTC ratio being heavily in Bitcoin’s favor for the next few years, at least until Ethereum is able to step more into its destined ultra-sound money role.

With current global geo-political trends, the impact of modern monetary theory on Europe and America, the growing acquisition of BTC by companies and central banks, and the central bank squeeze (which I think is coming), I think the global conditions are aligning extremely well to benefit Bitcoin’s narrative as risk-off digital gold and as a digital reserve asset.

On the other hand, ETH’s destiny is different. The narrative around ETH (at least that I ascribe to) is as ultra-sound money, a vehicle that will operate less like gold and a lot more like the foundation of a digital monetary system, with yield-bearing ETH, flexible smart contracts, and deflationary burn pressure. However, the promise of this is still several years and lots of technological developments away.

The Bottom Line:

In the long term, the promises of ETH and BTC are different. In the future, I expect them to move independently of each other, according to their risk classes and the relevant economic and geopolitical developments.

However, as of now, they’re both too early in their adoption cycles to move independently of each other. They’re still considered “crypto” to most people, and I think a bull market will benefit them both.

I am also still very optimistic about Ethereum. First, 29% of ETH is locked up in staking protocols, demonstrating significant long term trust in Ethereum. Second, Bitwise just acquired Attestant, a $3.7B Ethereum staking provider, a sign of things to come for institutional ETH buyers? I’d say so.

For now, in my opinion, hold onto your ETH bags. Good things are coming.

I’m just a man with a limited amount of time and capacity in my eyeballs to focus on a screen, but the bit question that still needs answering is:

“Well, yeah, Noam, maybe the market and price fundamentals point at this being like any old bull market, but what if Ethereum is fundamentally dying, being devoured by ETH-killing parasites, and it is slowly rotting?” Good question. That’s a topic I plan to tackle.

In future articles, I think the two topics that need to be unpacked are:

- Maybe the optimism around Bitcoin is unfounded, and it doesn’t have as bright of a future as we thought.

- Maybe the pessimism around Ethereum is unfounded, and its bull-case isn’t years away like we thought, but much closer.

Also, ya’ll know this is not financial advice, right?

Why Is Ethereum Lagging Behind Bitcoin? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

37

2 months ago

37

English (US) ·

English (US) ·