- Jupiter Crypto burned 3 billion JUP tokens and launched a $600 million buyback to reduce supply and boost long-term value.

- JUP’s price hit a 30-day high of $1.28 but faces key resistance at $1.1500-$1.2000, with support between $0.7600-$0.8200.

- Open interest dropped from $260 million to $182 million, reflecting cautious sentiment despite market stabilization.

Jupiter Crypto, a Solana-based decentralized exchange, has made bold moves to reshape its tokenomics, burning 3 billion JUP tokens and launching a $600 million buyback plan. These initiatives aim to reduce emissions and cut the fully diluted valuation (FDV), signaling a long-term strategy for value growth.

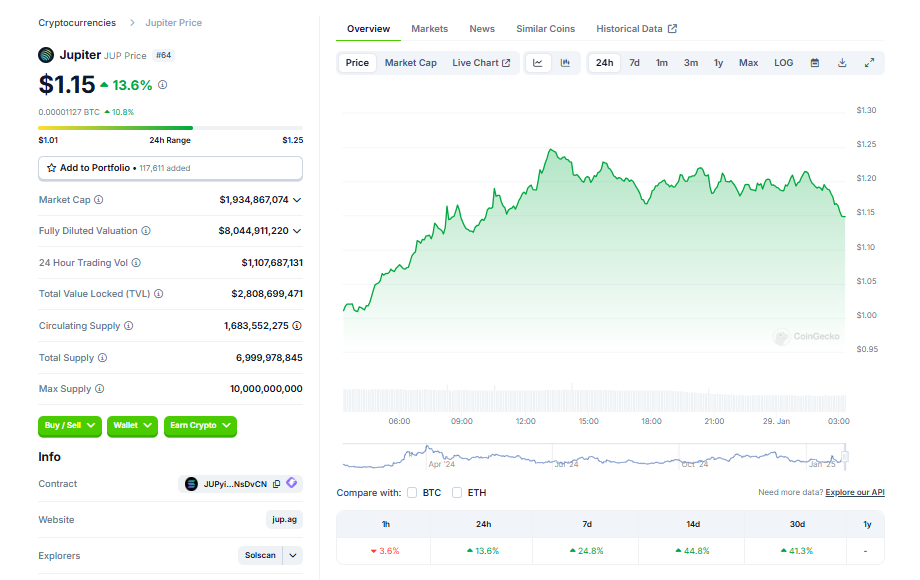

Jupiter’s native token, JUP, has emerged as a standout performer in an otherwise shaky crypto market. While total market capitalization dropped 6%, JUP managed an 8.89% weekly boost. However, the token saw a 12.64% dip over the past 24 hours, highlighting its volatile but resilient price action.

Token Burn and Buyback Plans Unveiled

During Catstanbul 2025, Jupiter announced its ambitious plan to burn $3.6 billion worth of JUP tokens and buy back $600 million more. The platform’s pseudonymous founder, ‘Meow,’ emphasized that this initiative focuses on cutting supply to bolster long-term token value.

Half of Jupiter’s protocol fee revenue will fund the buyback program, with the purchased JUP tokens stored in a so-called “long-term litterbox” to stabilize value. Additional revenues will be directed toward operational growth and future expansion.

Market Reactions and Key Price Movements

Investor enthusiasm following the announcements pushed JUP’s price to a 30-day high of $1.28, representing a 37% gain in a short window. However, as the broader market faced turbulence, JUP’s price dipped to $1.05, with trading volumes reaching $1.72 billion. The token’s market cap currently stands at $1.78 billion, sitting 50% below its all-time high of $2.04 achieved in January 2024.

Crypto analysts are closely watching JUP’s price action, with critical support levels identified between $0.7600 and $0.8200. Resistance is expected around $1.1500 to $1.2000, which could test the token’s upward momentum.

Technical Analysis Points to a Bullish Outlook

JUP/USDT charts suggest a bullish structure, with price movements bouncing off key support zones. Analysts observed a liquidity sweep below a recent swing low, triggering stop-loss orders before a sharp rally to a new high.

The bullish order block (OB) between $0.7600 and $0.8200 may act as a demand zone if the price revisits these levels, potentially setting the stage for a continued rally. However, resistance at $1.1500 and $1.2000 could challenge further upside.

Open Interest Decline Highlights Market Caution

Data from Coinalyze shows that JUP’s open interest peaked at $260 million before dropping sharply to $182 million, reflecting reduced trading activity. Despite the decline, open interest has since stabilized around $180 million, suggesting cautious optimism among market participants.

Looking Ahead

Jupiter’s tokenomics overhaul has sparked attention in the crypto community. Market players are watching closely to see how these strategies influence JUP’s price trajectory and whether the bold moves will translate to sustained growth in a volatile market.

With its current trajectory, JUP could either cement its status as a top-performing token or face significant hurdles from shifting market dynamics. Only time will tell how this ambitious plan plays out.

8 months ago

65

8 months ago

65

English (US) ·

English (US) ·