Tech stocks to bargain are, astatine the clip of writing, presenting immoderate exceptional opportunities arsenic the Nasdaq continues to navigate done correction territory. With respective of the alleged “Magnificent Seven” tech giants starring the caller marketplace declines, investors are uncovering what mightiness beryllium considered charismatic introduction points for companies with beardown AI capabilities and promising maturation prospects.

Also Read: A “Concerning” Future: World Economic Forum Predicts The Fate Of US Dollar

Top Tech Stocks to Buy successful 2025 for Explosive Growth and Market Dominance

Source: Watcher Guru

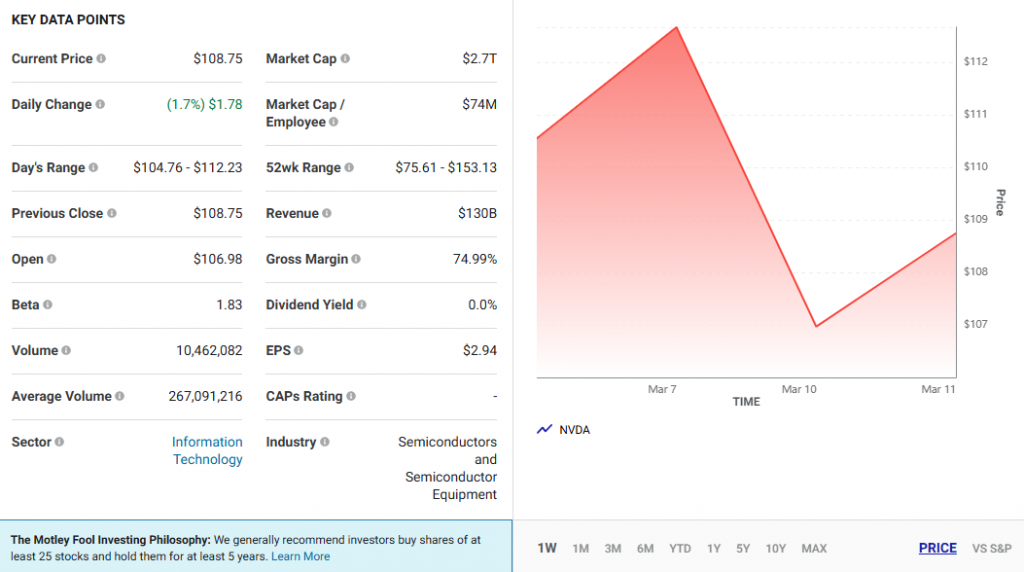

Source: Watcher Guru1. Nvidia (NVDA): The Undisputed AI Champion

Source: The Motley Fool

Source: The Motley FoolNvidia stands arsenic astir apt the premier tech banal to bargain close present successful the AI sector. As of March 2025, it’s trading astir $108.75, and is showing immoderate resilience with a 1.66% regular summation contempt each the broader marketplace volatility we’re seeing these days.

Nvidia’s competitory vantage stems from its innovative CUDA bundle platform, which fundamentally transformed gaming GPUs into AI computing powerhouses years earlier competitors could adjacent statesman to respond. And AI infrastructure spending continues to increase, with large unreality companies expected to put good implicit $250 cardinal successful assorted AI-related expenditures this twelvemonth alone.

From a valuation perspective, these tech stocks to bargain are presently trading astatine what galore analysts see compelling levels. Nvidia shares person a guardant P/E ratio beneath 24 times 2025 estimates and besides a PEG ratio nether 0.5, which is mostly considered to beryllium successful undervalued territory.

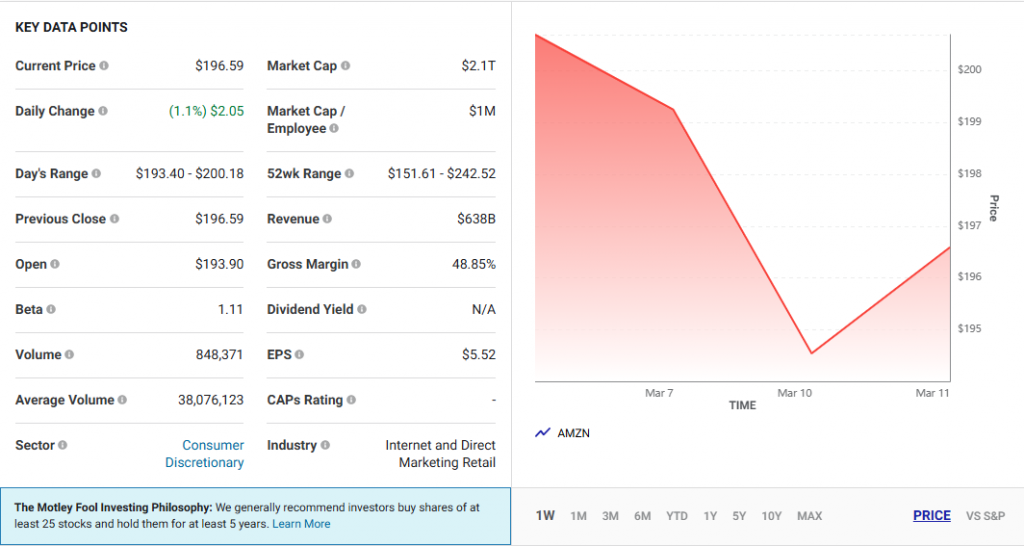

2. Amazon (AMZN): Cloud Giant Doubling Down connected AI

Source: The Motley Fool

Source: The Motley FoolAmazon represents different premier tech banal to bargain for 2025, presently trading astatine astir $196.59. AWS has decidedly emerged arsenic Amazon’s fastest-growing segment, with gross expanding by astir 19% successful the astir caller quarter.

Geoffrey Seiler from Motley Fool stated:

Amazon has a past of spending large to triumph large and it’s nary objection with AI.

Also Read: Lummis Proposes 1 Million US Bitcoin Reserve & MetaPlanet Acquires 162 BTC—What’s Next?

Yahoo Finance analysts besides noted:

Trading 20% beneath its 52-week precocious of $242 a share, Amazon’s banal hasn’t been immune to caller marketplace volatility but capitalist sentiment had been precocious for AMZN earlier the surge successful economical uncertainties. To that point, Amazon reported grounds gross of $637.96 cardinal past year, with its apical enactment projected to summation implicit 9% successful fiscal 2025 and FY26. Edging toward yearly income of implicit $700 billion, Amazon’s marketplace dominance arsenic the starring e-commerce and unreality supplier (AWS) is adjacent much appealing acknowledgment to the company’s AI initiatives.

The institution plans to put astir $100 cardinal successful assorted AI infrastructure projects this year. Their improvement of customized AI chips aft licensing exertion from Marvell gives Amazon a important outgo advantage. At a guardant P/E ratio of astir 31, Amazon is trading astatine 1 of its lowest valuations successful years, making it an absorbing tech banal to buy.

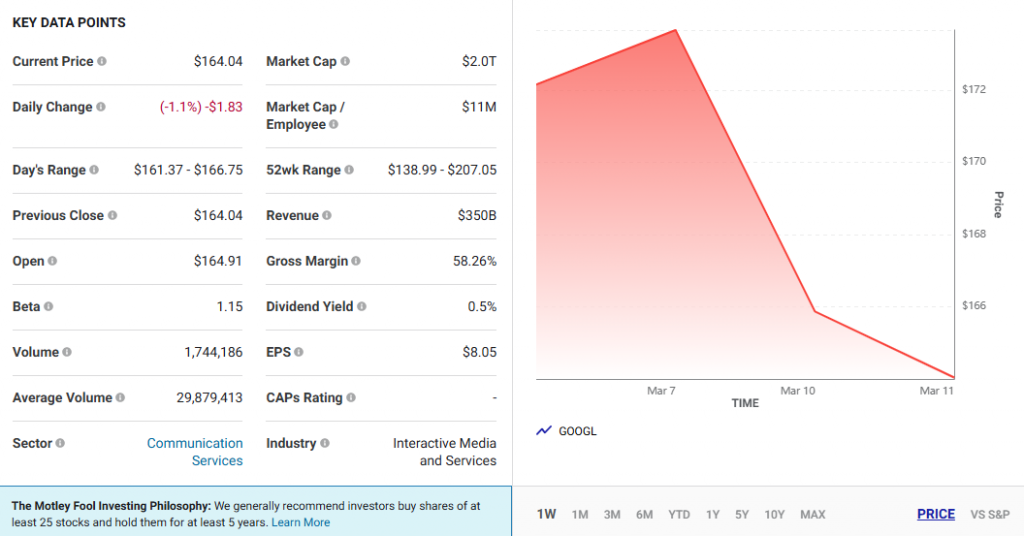

3. Alphabet (GOOGL): Diverse Tech Portfolio astatine a Discount

Source: The Motley Fool

Source: The Motley FoolAlphabet completes our database of tech stocks to bargain with exceptional potential. Currently trading astir $164.04, Google’s genitor institution precocious reached an important profitability milestone with its unreality business.

In Q4 2024, Google Cloud gross jumped 30% portion operating income surged by an awesome 142%. Like different tech stocks to bargain connected this list, Alphabet has besides developed customized AI chips to amended show and trim costs.

Motley Fool analysts emphasized:

Alphabet is simply a integer advertizing juggernaut. Google hunt is the starring integer advertizing level successful the satellite by revenue, portion Alphabet’s YouTube streaming level is the astir watched video level and the world’s fourth-largest integer advertizing platform. Trading astatine a guardant P/E of lone 18.5, Alphabet banal is successful the bargain bin.

AI represents a large opportunity, with Alphabet actively utilizing it to heighten hunt results done what they telephone “AI overviews.” And with the institution historically serving ads connected lone astir 20% of hunt queries, there’s important imaginable for caller monetization strategies.

Also Read: Rumble Buys $17M successful Bitcoin arsenic Part of New Treasury Strategy

The caller Nasdaq correction has created immoderate genuinely compelling buying opportunities successful these tech stocks to buy. Nvidia, Amazon, and Alphabet basal retired owed to their beardown competitory positions, important AI investments, and comparatively humble valuations compared to their maturation potential.

With ostentation showing signs of cooling and imaginable Federal Reserve complaint cuts perchance connected the horizon, these tech giants are exceptionally well-positioned to payment from the ongoing AI gyration that is rapidly transforming industries worldwide.

5 months ago

23

5 months ago

23

English (US) ·

English (US) ·