The cryptocurrency market has resumed its downtrend today, with the market cap losing $125 billion over the last 24 hours.

However, a few altcoins have defied the broader downtrend, attracting traders’ attention with their price movements.

Official Trump (TRUMP)

The Donald-Trump-linked Solana-based meme coin TRUMP is one of the most searched altcoins today. This comes amid the double-digit surge in MELANIA’s value over the past 24 hours, which has caused it to rank as the market’s top gainer.

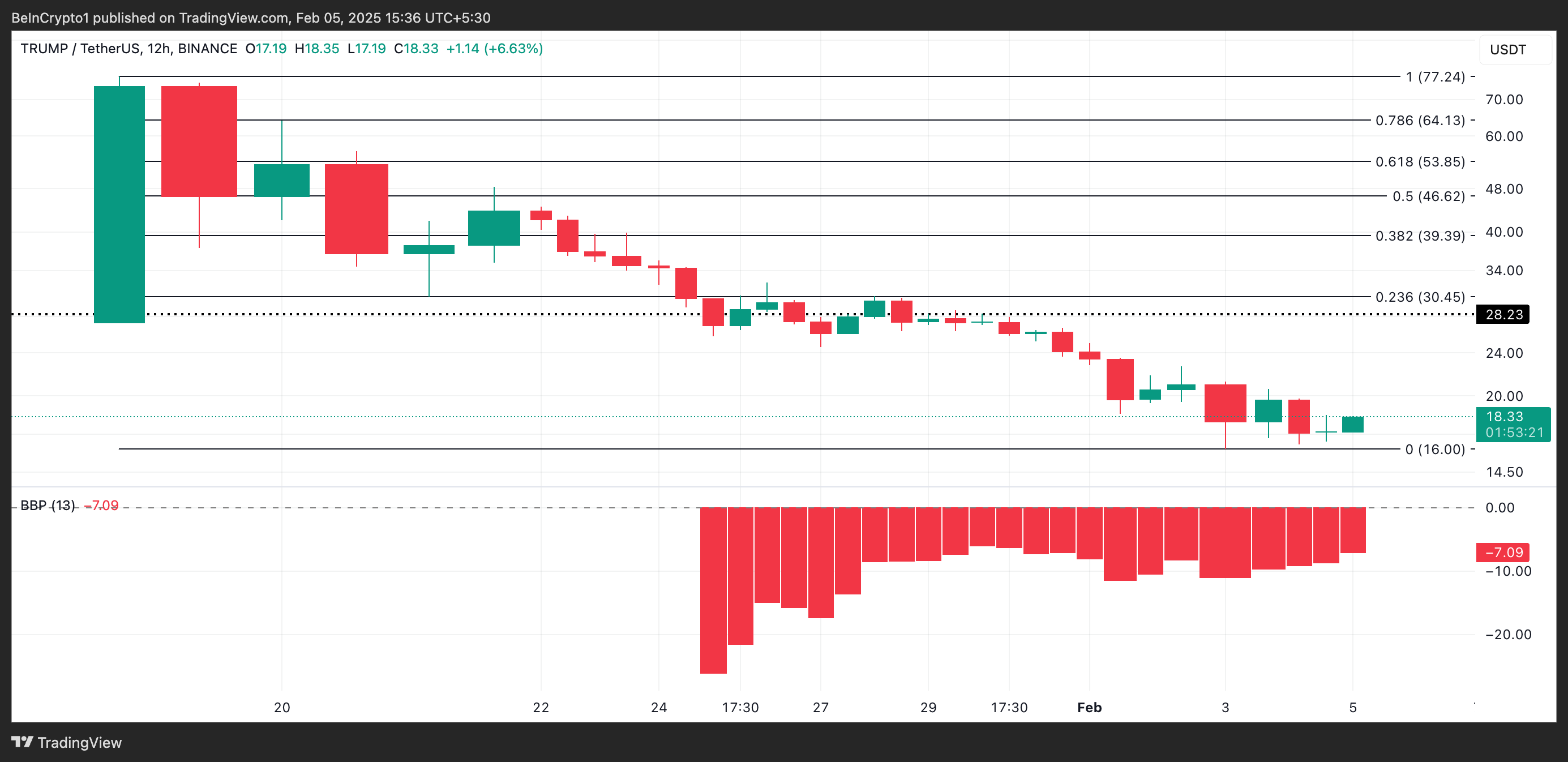

TRUMP trades at $18.33 at press time, registering a 6% price uptick in the past 24 hours. However, despite this rally, readings from its 12-hour chart suggest that bearish control over the meme coin remains significant.

For example, its Elder-Ray Index is at -7.09 as of this writing. This indicator measures the relationship between an asset’s buying and selling pressure in a market. When the index is negative, it suggests that sellers are in control, and the asset’s price is likely to face downward pressure.

Should this play out, TRUMP could shed its recent gains and fall toward $16.

TRUMP Price Analysis. Source: TradingView

TRUMP Price Analysis. Source: TradingViewOn the flip side, if the bulls regain market control, they could propel the meme coin’s value to $28.23.

Venice Token (VVV)

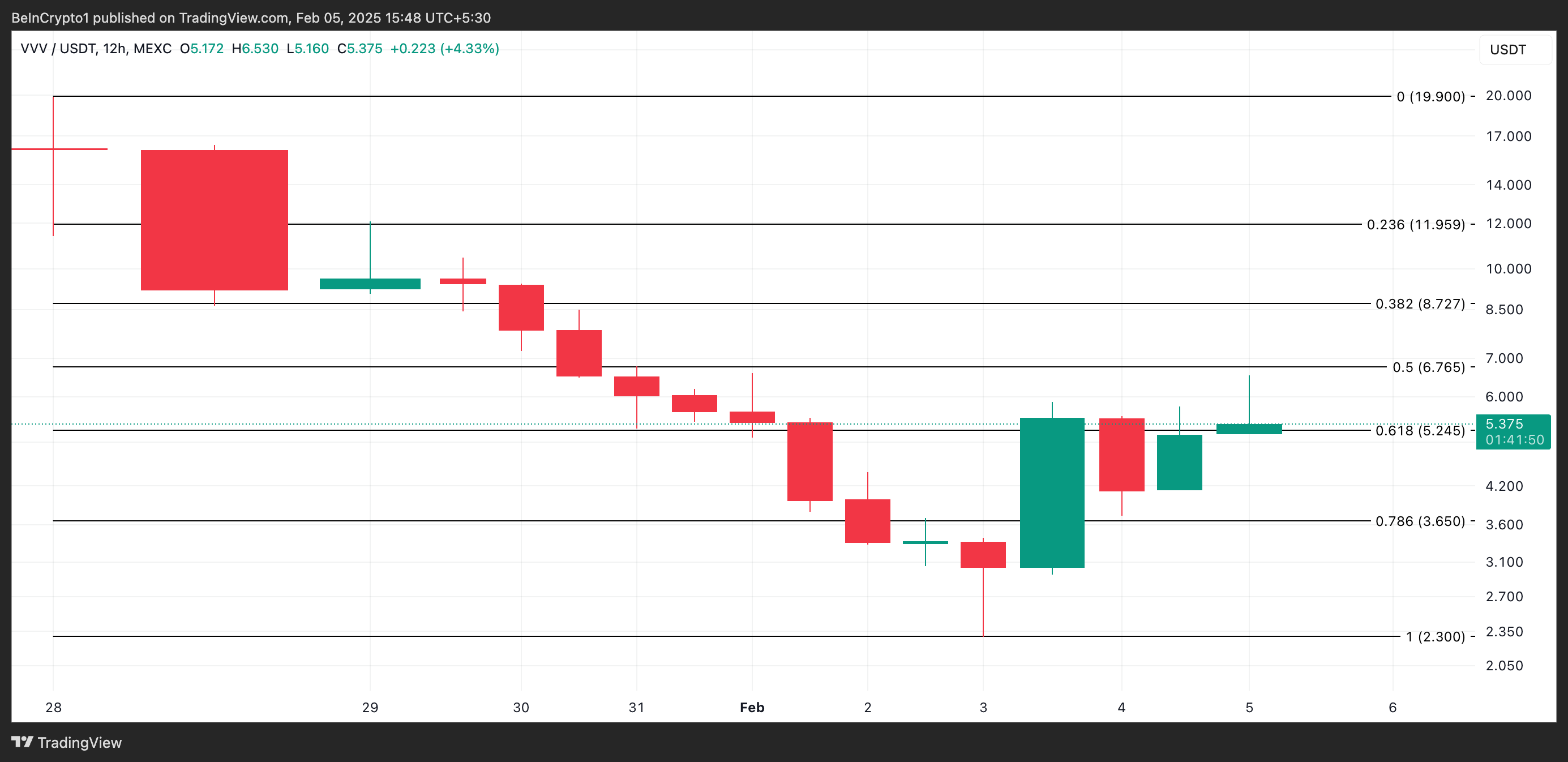

VVV is a trending altcoin today. Its price has jumped 44% in the past 24 hours despite allegations of misconduct against its developer team.

In a series of posts on X, analyst Ormu claims the team illegally issued themselves $5.7 million worth of VVV tokens after the Coinbase listing, raising transparency concerns.

According to Ormu’s analysis, the team allegedly sold $450,000 worth of these tokens via a fresh wallet linked to their multi-signature wallets.

However, these claims remain unverified as VVV notes a double-digit spike today. If the rally continues, the altcoin’s price could touch $6.75.

VVV Price Analysis. Source: TradingView

VVV Price Analysis. Source: TradingViewConversely, a price correction could cause VVV to drop below $5 to exchange hands at $3.65.

Solana (SOL)

Layer-1 (L1) coin SOL is also a trending altcoin today. As of this writing, it is trading at $205.13, recording less than a 1% price fall. Over the past week, the coin’s value has plunged 12% due to a broader market decline and low activity on the Solana network.

On the SOL/USD one-day chart, readings from the coin’s Directional Movement Index (DMI) reflect the bearish outlook. At press time, the Positive Directional Index (+DI, blue) is below the Negative Directional Index (-DI, orange), confirming the strength of SOL bears.

This indicator measures trend strength and direction using two key lines: the Positive Directional Index and the Negative Directional Index. When the +DI is below the -DI, bearish momentum is stronger than bullish momentum, suggesting a prevailing downtrend.

If the downtrend continues, SOL’s price could fall below the critical $200 level to $187.71.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingViewHowever, if market sentiment shifts from negative to positive and SOL accumulation resumes, its price could climb to $229.03.

The post Why These Altcoins Are Trending Today — February 5 appeared first on BeInCrypto.

6 months ago

33

6 months ago

33

English (US) ·

English (US) ·