The post Will Bitcoin Price Crash Below $70k appeared first on Coinpedia Fintech News

Since February 20, the Nasdaq Composite index has experienced a severe drop of 11.34%. During the same period, the Nasdaq 100 index has seen a significant decline of 10.94%. Interestingly, during this period, Bitcoin, known as digital gold, has witnessed a fall of 13.52%, indicating that the BTC market is currently following the trend of the US stock market. Highlighting this, popular gold advocate Peter Schiff challenges the attempt to push Bitcoin to the status of Gold – the most reliable store of value. Curious to know more? Read on!

Schiff Predicts Bitcoin Crash if Nasdaq Falls

At the start of this year, the Nasdaq composite index was at $19,401. Between January 1 and February 27, the market remained within the range of $20,087.23 to $18,902.75. On February 27, with a significant single-day drop of 3.46%, the market slipped below the range. Since February 20 alone, the composite index has declined by over 11.34%.

Likewise, at the beginning of the year, the Bitcoin price was around $93,587.07. Between January 1 and February 24, the market remained within the range of $92,540.01 and $106,151.77. Even though, on January 20, buyers attempted to push the price as high as $109,568.48, by the time of closing, the price of BTC plummeted to $102,294.18. On February 24, with a serious single-day of 4.97%, the price dropped below the range. Since February 20 alone, the BTC market has registered a drop of 13.52%.

Data show that the Bitcoin market is currently following the trend of the US stock market.

Peter Schiff compares the present scenario in the market with the Dot-com bubble, 2008 financial crisis and the 2020 COVID-19 crash.

Schiff predicts that if Nasdaq drops 20%, Bitcoin could hit $65K. He also forecasts that if the Nasdaq index slips 40%, the BTC market may crash to $20K or even lower.

Currently, the price of Bitcoin stands at $83,559.98 – at least 31.39% below the all-time high.

Gold Rising as Nasdaq Falls

Highlighting the potential of gold as a strong hedge against US economic uncertainties, Schiff notes that gold has increased by at least 13% while the Nasdaq has declined.

At the start of 2025, the gold spot price was around $2,624.653. Since then, the gold spot market has witnessed a rise of 13.86%. Between January 1 and February 24 alone, the market experienced a rise of 12.46%. Even since February 20, the market has seen a surge of 1.83%.

Currently, the gold spot price stands at $2,989.380. Schiff also forecasts that if stocks keep falling, gold could surpass $3,800.

- Also Read :

- Bitcoin Price Prediction for this Week

- ,

Bitcoin’s Credibility at Risk?

Exposing how Bitcoin has failed to rise to the status of gold as a reliable store of value and a strong hedge against economic uncertainties, Schiff expresses concerns about the feasibility of the Bitcoin Strategic Reserve proposal.

He states that if BTC crashes during economic uncertainties, governments may have no reason to hold it in their reserves.

He warns that Bitcoin ETF investors could panic and sell their holdings. He even points out that If BTC drops sharply, even MicroStrategy may need to sell its holdings.

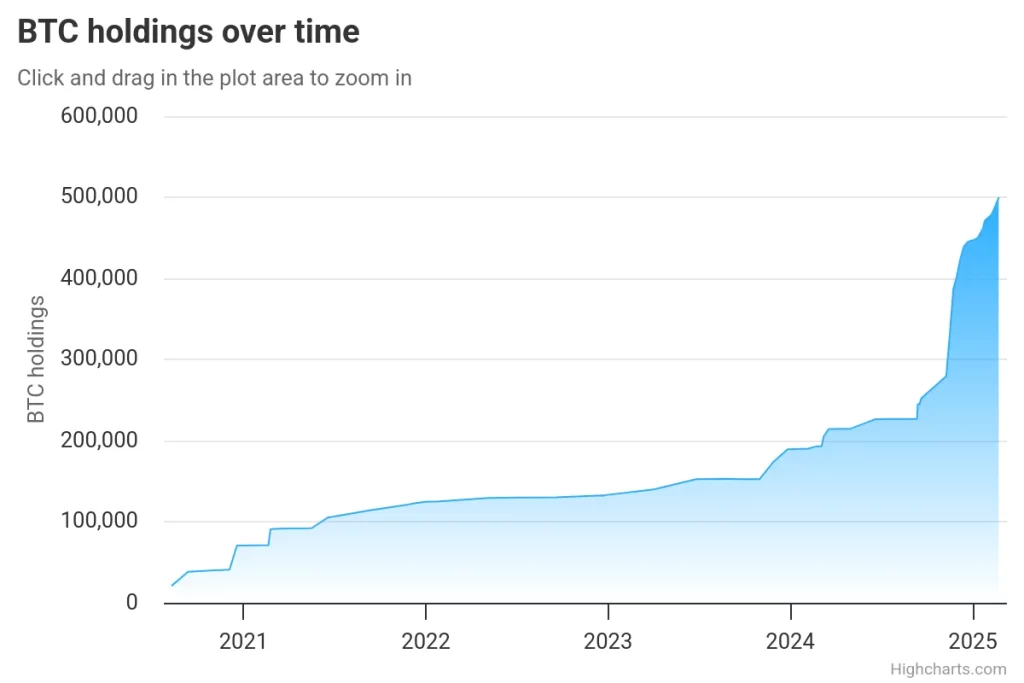

MicroStrategy is the publicly traded company that holds the largest number of BTC tokens. It owns no fewer than 499,096 BTC tokens, valued at $41,682,990,650.

The company has been a dedicated advocate of corporate crypto adoption. In November 2024, it even recommended tech giants like Microsoft adopt its aggressive crypto-buying strategy. Importantly, the short-term success achieved by this public company has encouraged many other companies to reverse their stance on crypto adoption.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

5 hours ago

14

5 hours ago

14

English (US) ·

English (US) ·