The Bitcoin price has started the week on a positive note, after witnessing downturn momentum on Tuesday, May 7. Notably, the price of the largest crypto by market, along with several other major altcoins, has gone through a tumultuous road in recent weeks due to a flurry of reasons. For instance, the significant outflow from the U.S. Spot Bitcoin ETF has weighed on the sentiments.

So, let’s take a look at the factors that have so far impacted the Bitcoin price, and how it may perform in the long term.

Factors Impacting Bitcoin Price:

The Bitcoin price was largely impacted this year due to U.S. Spot Bitcoin ETF approval, the Fed’s policy rate stance, and the Bitcoin Halving. Here we take a quick recap of the year.

Bitcoin ETF Hype

The Bitcoin price has noted positive trading since last year, as investors were anticipating the Bitcoin ETF. Notably, the approval of the U.S. Spot Bitcoin ETF in January has bolstered investors’ confidence. In addition, the positive influx into the investment instrument has also fuelled the market sentiment.

Meanwhile, the immense success of the Bitcoin ETFs has also sent the BTC price to its all-time high in mid-March. Simultaneously, the recent approval of the Spot ETF in Hong Kong has further bolstered confidence, while reflecting the the growing institutional confidence in the sector.

Federal Reserve’s Interest Rate

The Federal Reserve’s stance with their policy rates has also weighed on the sentiments so far this year. For context, the market was anticipating around five rate cuts through the year, while expecting the inflation to cool.

However, the economic data has shown that inflation has stayed strong while dampening hopes over potential rate cuts this year. Now, a flurry of analysts are expecting a single or two rate cuts through the year. Besides, some have also put their bets on no change in the policy rates in 2024.

Also Read: Bitcoin-based Apps Contributing Significant Portion of Miners’ Income

Bitcoin Halving

The Bitcoin Halving is one of the key events the market was waiting for in 2024. The recent Halving event has so far fuelled the confidence of the market participants, given its potential impact on the BTC in previous events.

Historically, the Bitcoin Halving event has triggered a significant rally in the BTC price, sending it to a new high. Considering that the market was also bullish towards the flagship crypto. However, several market pundits suggested a short-term volatility after the halving, while maintaining an upward trajectory for the long term.

Now that we have gone through some of the basic factors that have impacted the BTC performance significantly, let’s look at how the Bitcoin price might perform in the coming days.

Will Bitcoin Price Remain Stable In August?

Rekt Capital, a prominent crypto market analyst, provides insights into Bitcoin’s potential peak in the current cycle. Analyzing historical trends, he suggests Bitcoin could peak between mid-December 2024 and early March 2025.

However, he also noted that the ongoing deceleration in the cycle may lead to a resynchronization with traditional Halving cycles. As Bitcoin consolidates, the potential for stability and resynchronization increases, impacting its peak timeframe.

Source: Rekt Capital

Source: Rekt CapitalNotably, the analyst highlights that Bitcoin’s performance beyond old All-Time Highs has historically lengthened, suggesting a longer Bull Market Peak timeframe. With these factors in mind, investors anticipate stability and potential peak adjustments in the coming months, influencing Bitcoin’s price trajectory in August 2024.

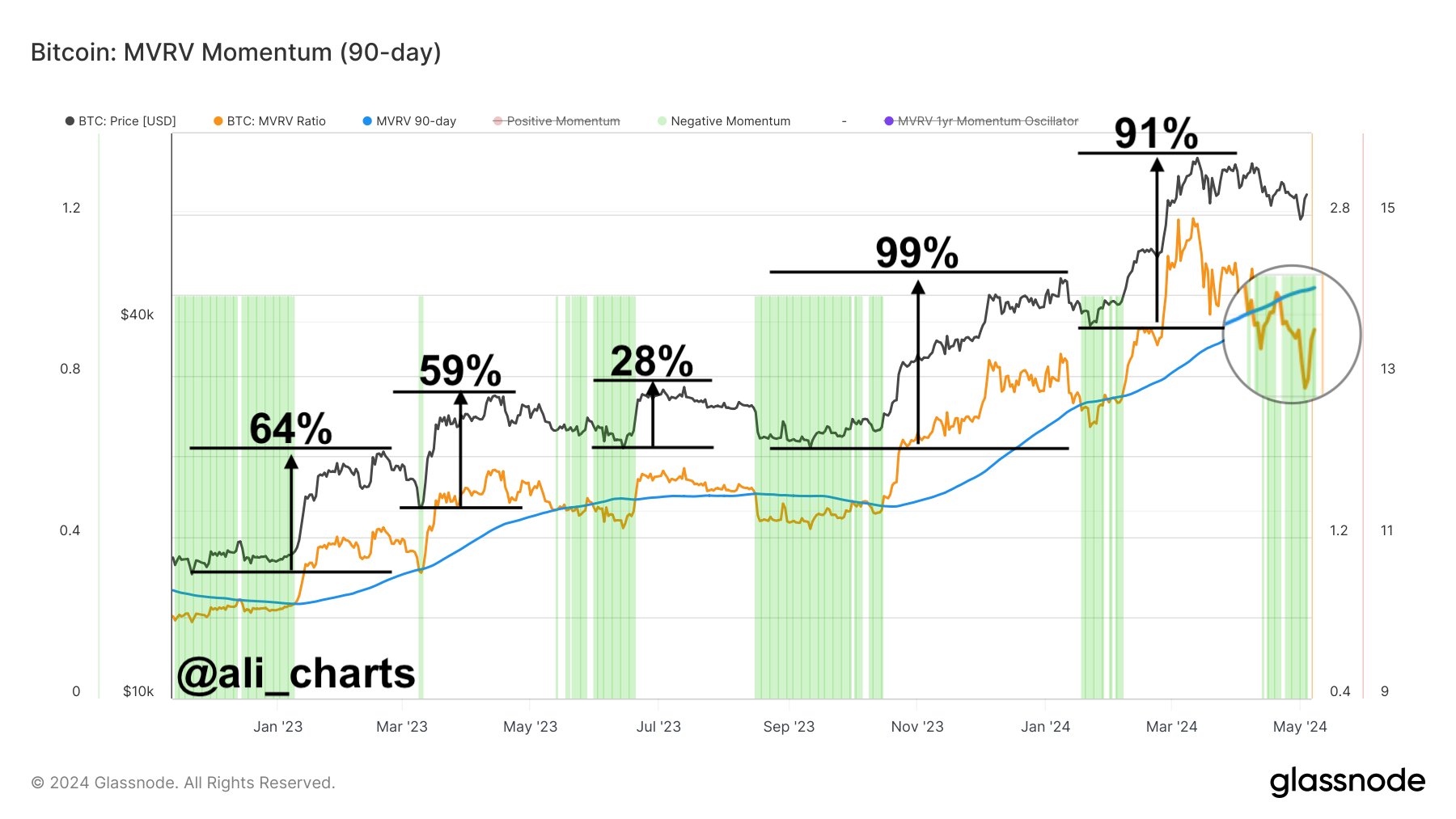

In addition, another market expert, Ali Martinez said that despite the recent advancement in Bitcoin price this week, the “MVRV 90-Day Ratio” suggests that Bitcoin is still under a “prime buy zone.” This has also fuelled the confidence of the investors, over a potential stability in the BTC’s trajectory in the coming days.

Source: Ali Martinez, X

Source: Ali Martinez, XSimultaneously, the recent U.S. Job data showed that the inflation pressure has cooled, although it still stayed above the Fed’s 2% target range. Given that, some have raised their bets over a potential rate cut in July. Notably, such a factor, if happens, could potentially boost the investors’ sentiment, and help Bitcoin maintain stability in August.

Meanwhile, as of writing, the Bitcoin price was down 1.10% and traded at $63,585.38, while its trading volume rose 67.61% to $30.56 billion. However, the crypto has touched a high of 65,494.90 in the last 24 hours.

Also Read: Pepe Coin Whale Dumps 1 Tln PEPE Amid 5% Price Drop, What’s Next?

The post Will Bitcoin Price Stay Steady Till August? Experts Analysis appeared first on CoinGape.

1 week ago

17

1 week ago

17

English (US) ·

English (US) ·