XRP terms has remained debased successful the past fewer days contempt the affirmative marketplace development. Many investors are cautious, arsenic the deficiency of terms question has near them uncertain astir its future.

However, determination is simply a affirmative improvement successful XRP ETF, the token struggles to summation momentum arsenic investors stay cautious.

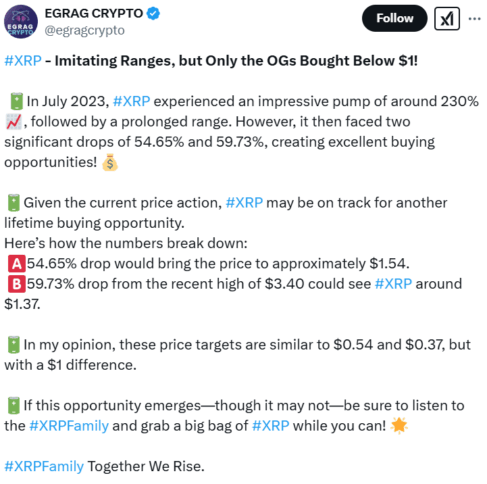

EGRAG CRYPTO’s Saying connected XRP, Source: X

EGRAG CRYPTO’s Saying connected XRP, Source: XOn the X, Market adept EGRAG CRYPTO said that XRP could a important earlier recovering based connected the past trends. He noted that XRP experienced a 230% surge, followed by 2 large drops of 4.65% and 59.73% successful July 2023. This has created beardown buying opportunities.

As per him, if a akin signifier happens now, a 54.65% driblet could bring XRP to $1.54, portion a 59.73% diminution could propulsion it down to $1.37. These levels lucifer erstwhile lows of $0.54 and $0.37, conscionable with a $1 difference.

However, immoderate analysts stay optimistic contempt concerns implicit a imaginable crash. On the X, Dark Defender precocious highlighted a cardinal Fibonacci level of $2.4467, suggesting that XRP mightiness beryllium acceptable for a rebound.

He pointed retired that the Relative Strength Index (RSI) shows oversold conditions, which could awesome an upcoming terms recovery. He besides noted that $2.33 is simply a beardown enactment level, meaning XRP could stabilize earlier moving higher.

XRP’s terms dropped 2% successful the past day, trading astatine $2.43 and its one-day trading measurement surged 40% to $5.49 billion. The token deed a 24-hour precocious of $2.49 and a debased of $2.32. Meanwhile, its Relative Strength Index (RSI) stands astatine 39, suggesting that XRP is nearing an oversold condition.

The crypto has fallen 29% from its January precocious of $3.39. Additionally, XRP Futures Open Interest has dropped from $7.86 cardinal successful mid-January to $3.5 billion, reflecting a bearish marketplace sentiment.

Despite this, experts stay optimistic owed to affirmative marketplace developments. The increasing involvement successful an XRP ETF has strengthened bullish sentiment. Furthermore, a apical lawyer suggested XRP could beryllium added to the US Strategic Reserve erstwhile it reaches $5.

While XRP could driblet to $1.4, marketplace sentiment remains bullish. A imaginable correction could connection amended introduction opportunities for investors astatine little prices.

Also Read: Investors May Soon Access XRP Through Regulated Receipts

8 months ago

44

8 months ago

44

English (US) ·

English (US) ·