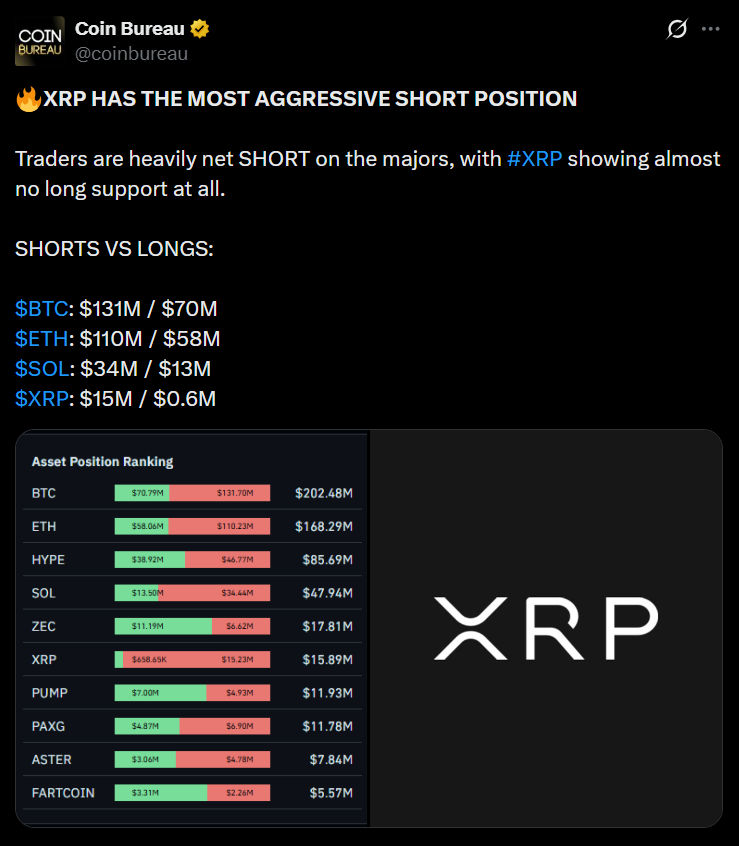

- XRP shorts sit near $15M vs. only $600K in longs, the worst imbalance among major assets.

- Extreme short pressure puts the altcoin at risk of dipping toward $1.80 if liquidations hit.

- Traders are advised to wait for cleaner dips rather than entering during heavy downside pressure.

Ripple’s XRP is sitting in a rough patch right now as traders pile into short positions at a pace that no other major altcoin is facing. The imbalance between buyers and sellers has widened dramatically, leaving XRP on a slippery slope where even small moves could trigger outsized reactions. Unlike Bitcoin, Ethereum, or even Solana, none of them have come close to this level of short-heavy positioning, making XRP the riskiest of the group at the moment.

Traders Outnumber Holders in a Big Way

Fresh data from Coin Bureau shows just how dramatic the gap has become: XRP shorts total nearly $15 million, while longs sit at only about $600,000 — a difference so large it almost feels unreal. This level of pressure can pull the price down fast if conditions worsen or liquidations stack up. When the short-side outweighs the long side by this much, the market tends to lean into the weaker direction, pushing price action lower rather than giving it any real chance to rebound.

Comparing XRP Against BTC, ETH, and SOL

To put things in perspective, here’s the snapshot traders are looking at: Bitcoin sits with $131M in shorts vs. $70M in longs, Ethereum has $110M vs. $58M, Solana has $34M vs. $13M. None of those look great, but XRP stands out as the only asset where shorts overwhelm longs by such a massive ratio. At its current price near $2.08, a full liquidation wave could easily drag XRP toward $1.80 — nearly a 15% slide from where it trades today.

Best Strategy: Stay Patient and Wait for Cleaner Levels

With the market looking like this, taking a fresh entry into XRP becomes a risky move. The smarter strategy is simply to watch for cleaner dips and avoid forcing positions in the middle of heavy short pressure. A patient approach could pay off, especially if XRP stabilizes later this cycle. Buying near the lower end of a correction often gives traders the upside they need once momentum finally swings back.

The post XRP Faces Heavy Short Pressure as Sellers Dominate Positions – Here Is Why Traders Should Be Careful This Month first appeared on BlockNews.

1 month ago

64

1 month ago

64

English (US) ·

English (US) ·