- Rietveld believes XRP could reach $10–$20 within one to two years due to Ripple’s GTreasury acquisition.

- GTreasury processes $5–$10 trillion annually, creating potential real corporate demand for XRP settlement flows.

- Integration could drive long-term utility, liquidity needs, and structural value growth that supports higher price targets.

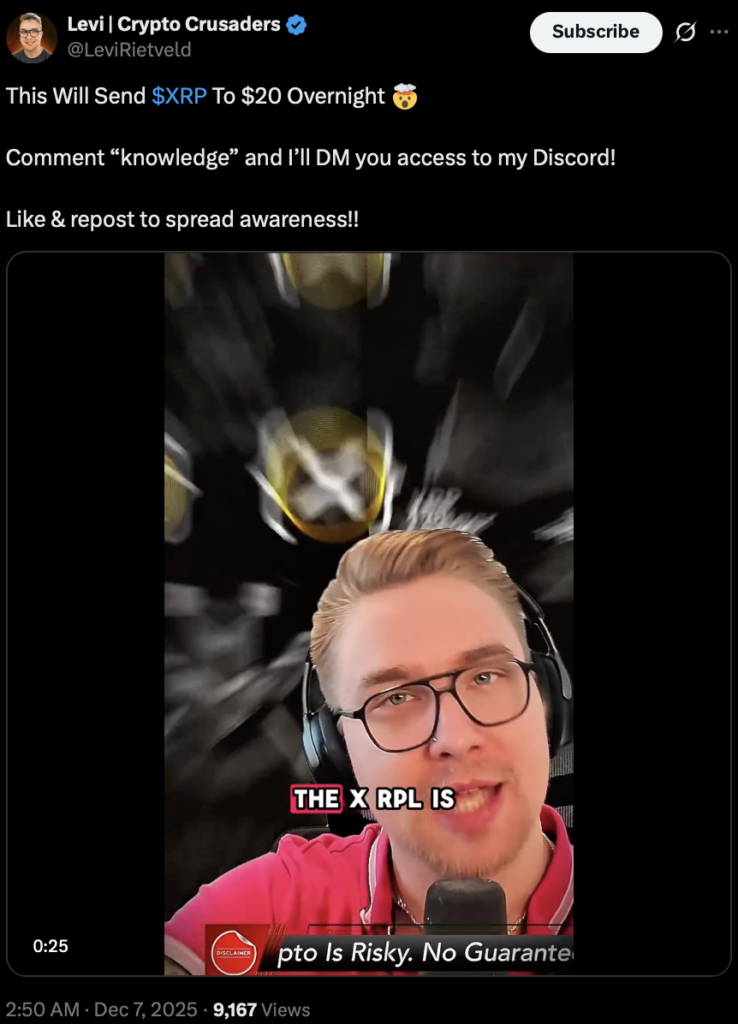

Crypto Crusaders creator Levi Rietveld stirred up a whole lot of chatter this week after dropping a surprisingly confident prediction: he believes XRP could climb to somewhere between $10 and $20 over the next one to two years. It wasn’t just a random moonshot claim either — he tied it directly to Ripple’s completed acquisition of GTreasury, a deal that many people in the space are quietly calling a turning point. GTreasury handles somewhere between $5 to $10 trillion in cross-border payment flows each year, and Rietveld thinks those flows will eventually settle across the XRP Ledger once Ripple fully integrates everything. It’s a big claim, yeah, but not without some logic behind it.

Rietveld’s Targets and the Math Behind Them

Rietveld focused heavily on scale and efficiency rather than hype. With XRP trading around $2.05 right now, a move to $10 would mean roughly a 387% jump, while $20 would be closer to an 875% climb — numbers that may look intimidating but aren’t unheard of in crypto cycles. He insists these targets aren’t guesswork, but simply the natural outcome of corporate-level usage colliding with a settlement asset built for speed. Once GTreasury’s massive client base begins settling through Ripple’s rails, he argues, XRP gains utility that didn’t exist before. And in crypto, utility tends to drag price along with it sooner or later.

GTreasury’s Place in This New System

Ripple’s $1 billion acquisition of GTreasury officially closed after the initial announcement back in October 2025. GTreasury isn’t some small fintech startup — it’s a major treasury management platform that global corporations have relied on for decades. Their system handles payment routing, liquidity management, cross-border operations, and more. Rietveld pointed out that this long-established foundation is now essentially sitting inside Ripple’s structure. If those same flows migrate to the XRP Ledger, the demand for XRP liquidity could rise sharply, simply because settlement at that scale requires deep, reliable infrastructure.

Why This Integration Could Be a Real Game Changer

Rietveld didn’t present the integration as some vague narrative; he framed it as a practical, measurable shift. GTreasury’s clients move enormous amounts of capital daily — trillions per year. These corporations want fast settlement, predictable costs, and secure channels, and Ripple’s system is built to deliver exactly that. Introducing XRP as the settlement asset in this environment gives it something it has struggled to maintain in the past: consistent real-world demand.

This puts XRP in front of a whole new category of users who actually need efficient settlement rather than speculative upside. That type of usage supports long-term value in a way most crypto assets never get to experience. Based on this mix of scale, corporate integration, and structural demand, Rietveld believes XRP could realistically hit $10 to $20 before 2027 — and whether people agree or not, his reasoning has captured plenty of attention already.

The post XRP’s Bold New Outlook – Here is Why a $10 to $20 Target Suddenly Doesn’t Sound So Wild. first appeared on BlockNews.

1 month ago

35

1 month ago

35

English (US) ·

English (US) ·