- Exchange-held XRP has dropped 29%, with billions leaving major platforms.

- New XRP ETFs are absorbing supply into cold storage.

- Key levels: $2.60 for momentum, $3.40 for breakout, 21 EMA for downside risk.

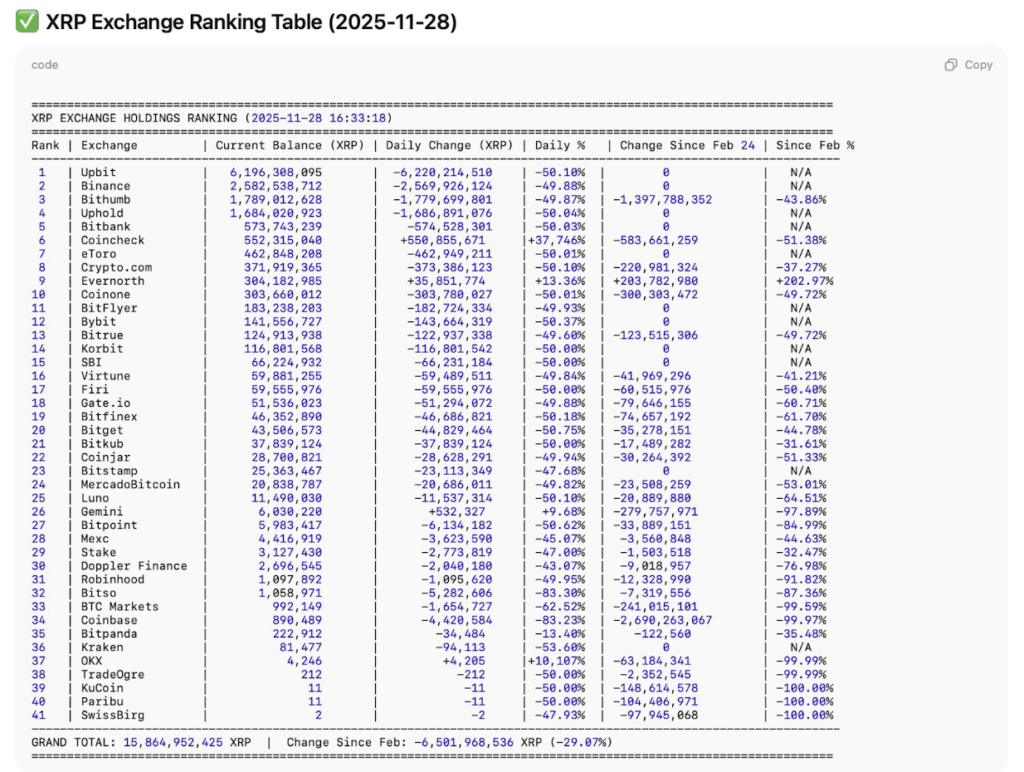

XRP liquidity is shifting in a way the market hasn’t seen in years. On-chain data shows one of the largest coordinated drops across nearly every major exchange, with billions of XRP leaving trading platforms in a short time. Analysts say it’s not a random blip — something bigger seems to be happening beneath the surface.

Total XRP held on exchanges has plunged to 15.86 billion, down 6.5 billion XRP since February — a staggering 29% decline. Upbit alone lost 6.22 billion XRP, Binance shed 2.56 billion, and Bithumb saw 1.77 billion withdrawn. Meanwhile, platforms like Uphold, eToro, Bybit, and Bitbank reported balance declines around 50%.

This kind of synchronized movement almost always hints at major behavioral shifts — possibly users moving to self-custody, institutional wallet migrations, or internal rebalancing ahead of new products.

Some exchanges gain — but most see historic declines

A few platforms bucked the trend. Evernorth gained 13.36% in XRP holdings, Coincheck pulled in 550 million XRP, and OKX showed a massive 10,107% balance jump that analysts believe may stem from address reclassification rather than real inflows.

On the opposite extreme, some exchanges saw near-total wipeouts. Coinbase’s XRP balance collapsed 99.97%, and KuCoin, Paribu, and SwissBorg all recorded dramatic exits. These data points suggest a broad reshuffling of liquidity — the kind that could reshape how XRP trades in the months ahead.

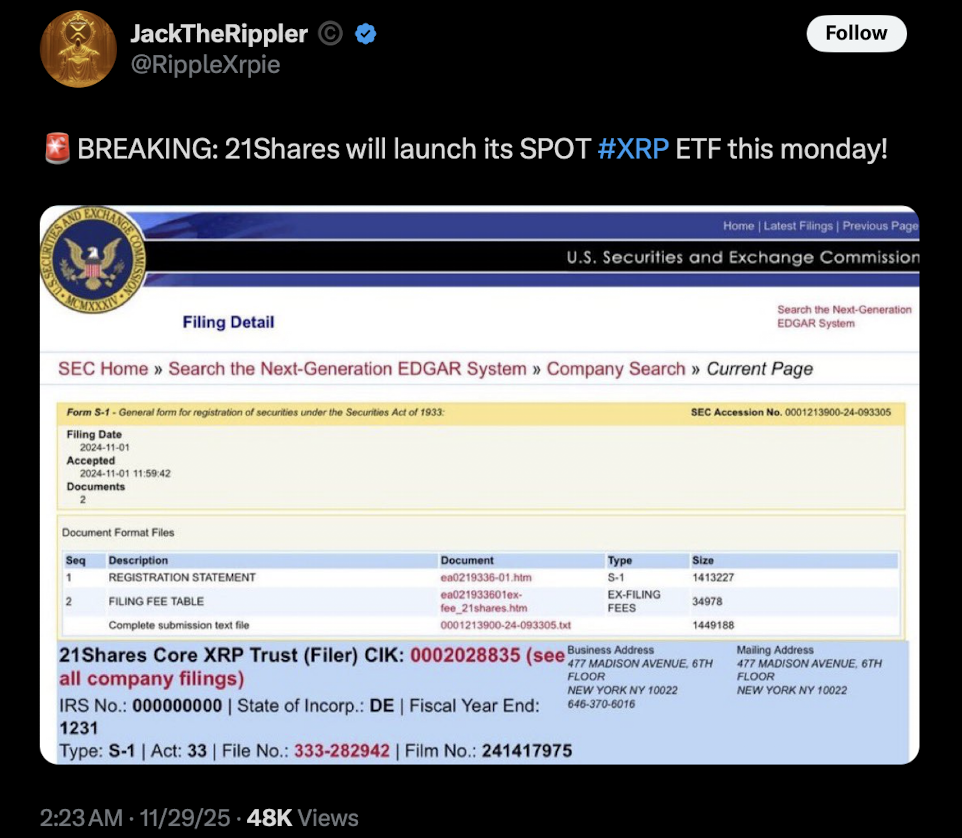

The timing is no coincidence — a new U.S. spot XRP ETF launches Monday

All of this comes just as the 21Shares U.S. spot XRP ETF (ticker: TOXR) prepares to launch. The ETF tracks the CME CF XRP-Dollar Reference Rate, giving investors exposure to XRP’s spot price through traditional markets — without touching the token directly.

The U.S. has already seen rapid ETF momentum. Grayscale’s GXRP and Franklin Templeton’s XRPZ pulled in $67.36 million and $62.59 million on day one. Heavy early inflows, combined with the liquidity drain on exchanges, suggest institutions may be pulling XRP into custody rather than leaving it on trading platforms.

ETFs require cold storage — meaning every inflow removes more XRP from active circulation.

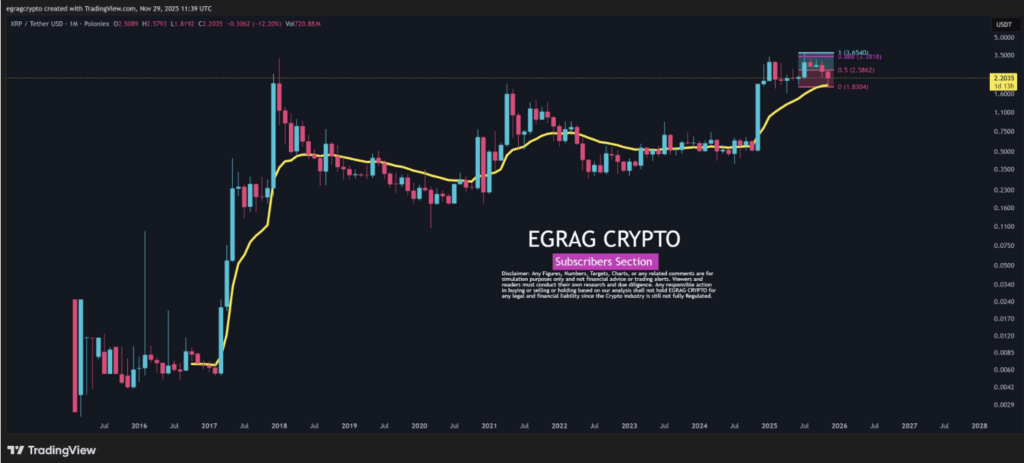

Technical outlook: major levels approaching

As of press time, XRP trades at $2.19, up 0.75% over 24 hours and up 13.61% over the week, giving it a $132 billionmarket cap. According to EGRAG CRYPTO:

- Above $2.60: early bullish momentum

- Above $3.40: confirmed strong uptrend

- Below the 21 EMA: possible bearish reversal

With liquidity tightening and ETFs absorbing supply, these technical levels could become far more reactive than usual.

Final thoughts

XRP is entering a transformative phase — exchange balances are dropping, ETFs are absorbing tokens into cold storage, and market behavior is shifting at scale. Massive outflows, rising institutional products, and sensitive technical levels create a mix of opportunity and risk.

Here is where traders should watch exchange balances, ETF flows, and price structure closely — because XRP’s liquidity landscape is changing faster than most expected.

The post XRP Supply Crunch Looms as Spot ETFs Accumulate Millions of Tokens — Here Is How It Could Impact Price first appeared on BlockNews.

3 weeks ago

27

3 weeks ago

27

English (US) ·

English (US) ·