A mentation of this nonfiction appeared successful our The Decentralised newsletter connected December 17. Sign up here.

GM, Tim here.

- Ethena’s USDe soars to a $5.8 cardinal supply.

- Should Bitcoin beryllium rebased?

- Cosmos changes people with a caller ecosystem team.

USDe’s connected fire

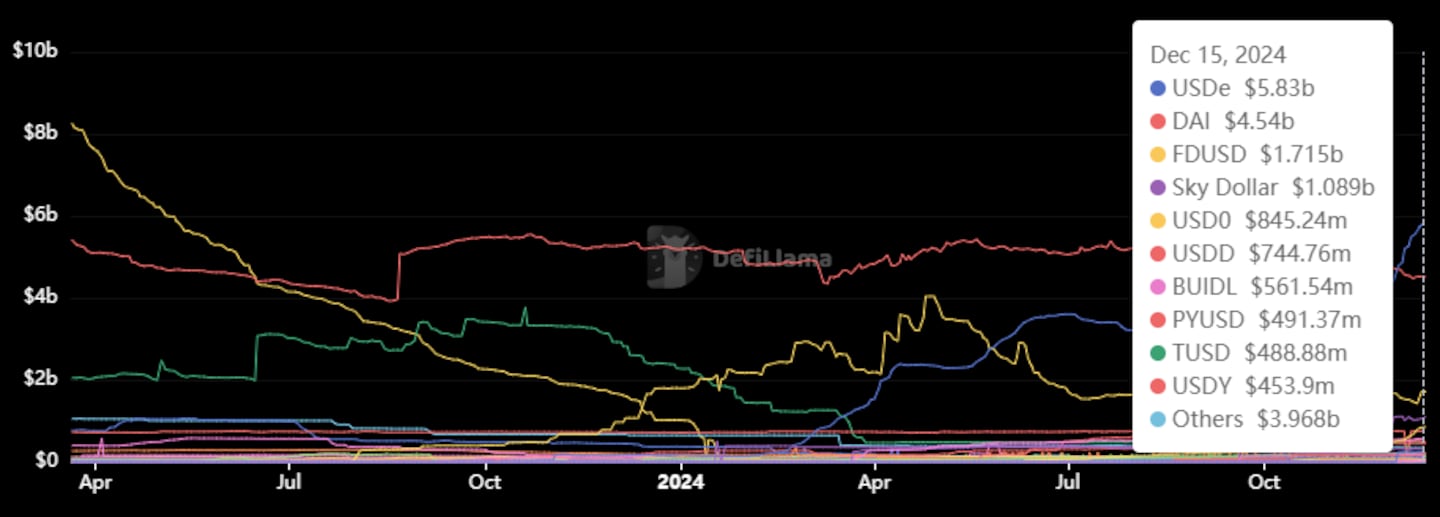

Ethena’s USDe has surpassed Sky’s Dai and USDS stablecoins, becoming the third-biggest dollar-pegged plus down Tether’s USDT and Circle’s USDC.

The token, which is backed utilizing a operation of volatile assets similar Bitcoin and derivatives, deed a circulating proviso of $5.8 billion, an 85% increase implicit the past month.

It’s the archetypal clip different dollar-pegged token has overtaken Dai since it ascended to the fig 3 spot successful June 2023.

USDe overtakes Dai and USDS combined. (DefiLlama)

Key to USDe’s occurrence is the output it offers. The token generates 27% annually, acold supra the 12.5% offered connected Dai and USDS.

To beryllium sure, USDe isn’t technically a stablecoin, and truthful comes with a antithetic acceptable of risks compared to different akin assets.

Stablecoins similar USDC and USDT are backed astatine a one-to-one ratio by dollars oregon dollar-equivalent assets similar US Treasury bonds.

USDe, connected the different hand, is created by depositing Bitcoin, Ether, oregon Solana to the Ethena protocol, which past opens shorts, oregon bearish bets, connected futures exchanges similar Bybit.

This creates a alleged delta neutral presumption wherever the worth of the assets and the abbreviated cancel each different retired to stay astatine a unchangeable terms successful aggregate.

Because astir traders are bullish connected crypto astatine the moment, they wage wealth to Ethena for shorting, which the protocol passes connected to USDe holders done staking.

As agelong arsenic this concern continues, yields connected USDe should enactment high. But if traders flip bearish, Ethena won’t beryllium capable to present specified precocious yields.

One ‘new’ Bitcoin?

Bitcoin advocator John Carvalho wants to redefine however the apical crypto is measured.

Right now, 1 Bitcoin tin beryllium divided into 100 cardinal sub units called satoshis.

What Carvalho wants to do is marque the satoshi the default portion of relationship and rename it to Bitcoin.

The change, akin successful conception to a immense 100 million-to-one stock split, would destruct the request for decimal places, and contiguous Bitcoin values successful full integers.

For example, what is presently shown arsenic 0.00010000 BTC would beryllium displayed arsenic 10,000 Bitcoin.

It’s not the archetypal clip the Bitcoin assemblage has debated changes to the asset’s portion structure.

In 2017, Jimmy Song projected BIP 176, which introduced “bits” arsenic a modular denomination, aiming to simplify tiny transactions.

Critics of some ideas caution that shifting the portion operation could confuse users, summation the hazard of mistakes successful transactions, and make logistical challenges for wallets and exchanges already built astir the existent system.

Cosmos’ ICF acquires Skip

Cosmos, is adding a fewer caller faces to revitalise the ailing project.

The Interchain Foundation, the organisation stewarding Cosmos, has acquired ecosystem squad Skip, renaming it to Interchain Inc.

Interchain Inc volition pb Cosmos’ product, vision, and go-to-market with Skip co-founders Barry Plunkett and Maghnus Mareneck astatine the helm, according to a blog station announcing the move.

At 1 point, Cosmos was 1 of the hottest projects successful crypto. It attracted DeFi giants similar perpetual futures speech dYdX to physique connected it, and formed a beardown confederation with information availability web Celestia.

But successful caller months, Cosmos has struggled. Controversies and ineligible fights implicating the project’s executives person shaken confidence.

Its ATOM token has besides lagged its competitors.

The anticipation is that with the assistance of Skip, Cosmos tin unite its fractured ecosystem and turn users and liquidity crossed each its interconnected blockchains.

This week successful DeFi governance

VOTE: CoW DAO to widen solver rewards to Arbitrum and Gnosis Chain

VOTE: Arbitrum mulls caller DAO-adjacent entity for strategy execution

VOTE: Gnosis DAO votes to make grants programme to incentivise aboriginal signifier DeSci projects

Post of the week

DefiLlama’s 0xngmi explores post-hack betterment rates for DeFi protocols.

among projects that had a large hack, lone 39% survived arsenic a project

projects that refunded users aft a large hack are 4.6x much apt to past and support existing vs those that didn't pic.twitter.com/DQ0F2xYdpb

Got a extremity astir DeFi? Reach retired astatine [email protected].

1 month ago

144

1 month ago

144

English (US) ·

English (US) ·