- About 8.9M BTC is underwater, the highest level of supply in loss since Jan 2023

- Bitcoin dropped below $65.5K after breaking under $67K earlier in the session

- US Bitcoin ETF inflows have fallen sharply since their October 2025 peak

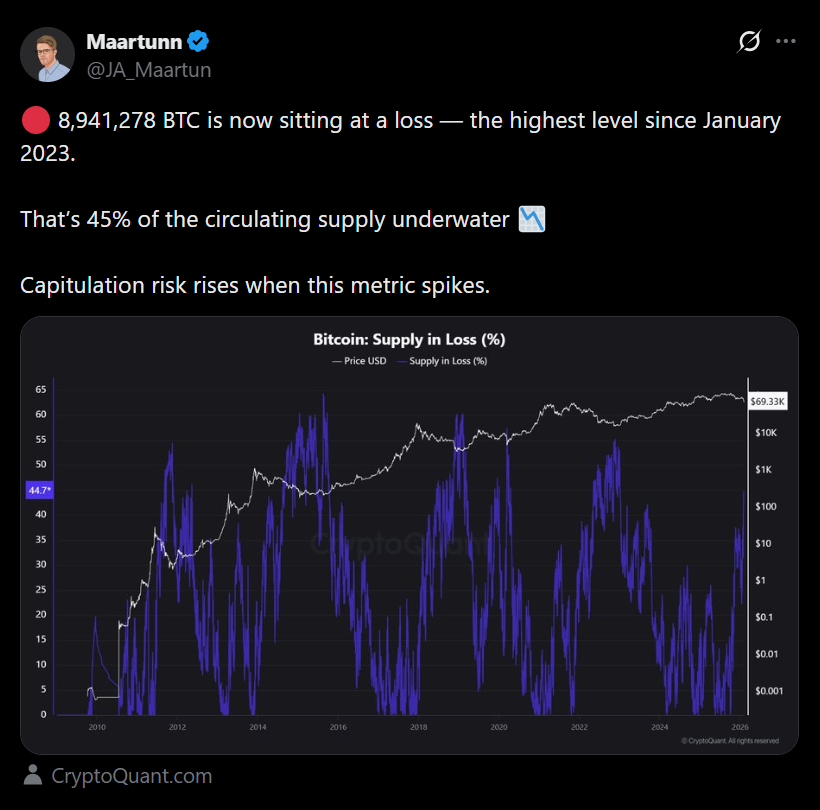

Around 8.9 million Bitcoin, roughly 45% of the circulating supply, is now underwater, according to CryptoQuant analyst J.A. Maartun. That’s the highest share of supply in loss since January 2023, and historically, spikes in this metric tend to raise capitulation risk. When more holders slip into red territory, pressure builds, not always immediately, but mechanically.

This doesn’t guarantee a collapse. But it does change the market’s emotional balance. When nearly half of supply is underwater, weak hands become easier to shake out, and even long-term holders start paying closer attention to downside levels.

Bitcoin Breaks Below $67K and Slips Under $65.5K

Bitcoin fell roughly 10% in the past 24 hours, dropping below $65,500 at the time of reporting. The move followed an earlier breakdown under $67,000, which had already been acting as a key psychological line after the recent selloff. Once that level failed, the decline accelerated quickly.

This kind of drop tends to bring out the worst version of crypto markets. Not because fundamentals suddenly changed, but because leverage and sentiment both unwind at the same time. Price moves faster than narratives can catch up, and that’s when panic trades start appearing.

ETF Outflows Add Another Layer of Stress

US Bitcoin ETFs also saw renewed pressure in late January 2026, recording net outflows that marked the second- and third-worst weeks in ETF history. That flow data matters because ETFs were widely viewed as the stabilizing force of this cycle. When they start bleeding, it signals that even slower institutional capital is trimming exposure.

Cumulative inflows have now declined by about 12.4% from their peak in October 2025. That doesn’t mean the ETF story is over, but it does suggest this phase is no longer about excitement. It’s about endurance.

Capitulation Risk Is Rising, but the Market Isn’t Broken

A rising “supply in loss” metric is often less about price itself and more about psychology. The market becomes more sensitive, sellers get louder, and buyers become hesitant, even if they still believe in the long-term thesis. That’s typically when capitulation becomes possible, not guaranteed, but possible.

If Bitcoin stabilizes and begins rebuilding structure, this period could later be viewed as a painful reset. If it fails to hold key levels, the pressure could deepen. Either way, the market is entering a zone where patience becomes a real edge, and impatience gets punished fast.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

2 hours ago

13

2 hours ago

13

English (US) ·

English (US) ·