- XRP is down roughly 59% from its 2025 high as broader crypto liquidity tightens

- Traders are focused on $1.50 as the key level separating bounce and breakdown

- Forecasts range from a dip toward $1.20–$1.30 to a rebound back above $2

XRP has been caught in the same brutal market conditions dragging down most major crypto assets. After topping near $3.65 in July 2025, the token has now dropped close to 59%, and price action is increasingly defined by defensive trading rather than upside narratives. XRP is currently hovering around the $1.59 area, with the market openly debating how much lower it can go before a rebound becomes realistic.

This isn’t XRP-specific weakness either. When Bitcoin struggles and liquidity tightens, altcoins tend to bleed faster, even the “large caps.” That’s exactly what the chart has been reflecting, with XRP slipping toward a zone where sentiment usually turns impatient.

The $1.50 Level Has Become the Psychological Line

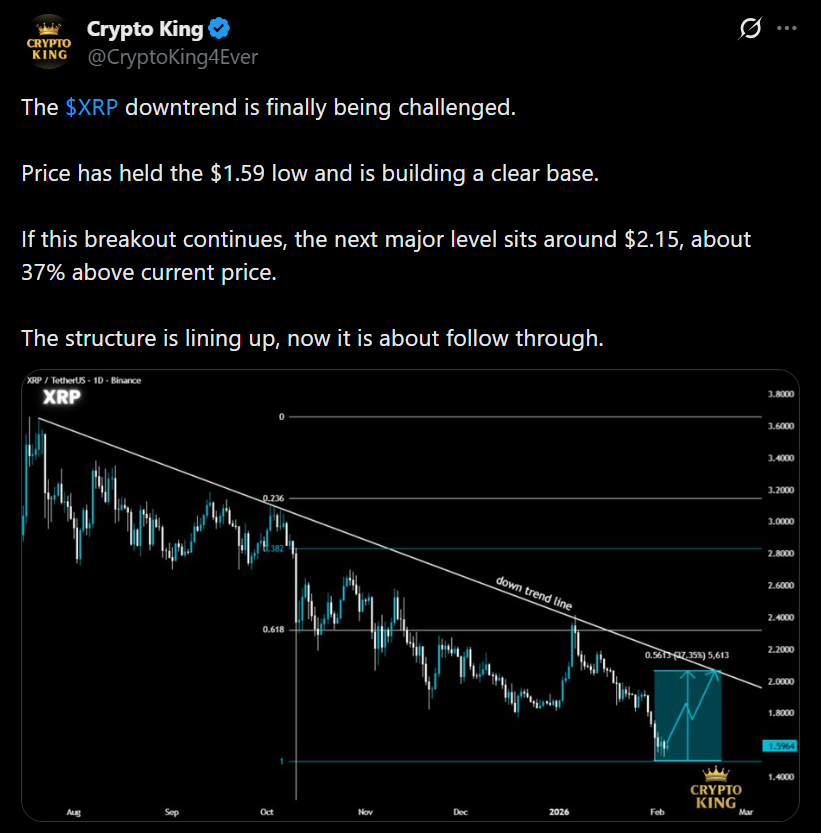

For traders, $1.50 is the number that keeps coming up. If XRP holds that level, some analysts believe a reversal toward $2 could unfold without needing a major catalyst, just a shift in follow-through and momentum. Crypto King described the recent structure as a base-building phase, arguing that if the breakout holds, XRP could target the $2.15 region, roughly 37% above current levels.

That said, the market is still fragile. A base only matters if buyers defend it, and right now, buyers across crypto are cautious. XRP may be building structure, but it’s doing it in a market that has punished optimism all year.

Some Traders See One More Dip Before Any Real Bounce

Other analysts are less optimistic in the short term. Chill Trader suggested XRP could still fall toward the $1.30 area before a breakout becomes possible. The view is based on a symmetrical triangle formation, a pattern that often appears during downtrends and can lead to continuation lower before relief arrives.

Even in that framework, the mid-zone around $1.50 remains the main battleground. The idea is simple. Price tends to react there, either rejecting and rolling over, or stabilizing long enough to build a launchpad. The rejection zone being watched sits around $1.62 to $1.65, which is where XRP has repeatedly struggled to reclaim momentum.

Forecasts Still Lean Higher, but Time Horizons Matter

Longer-range projections remain optimistic, though they come with the usual caveats. CoinCodex data suggests XRP could see continued volatility in the near term, potentially dipping toward $1.45 by the end of February. From there, the model implies XRP may gradually recover, with stronger upside showing up later in 2026, particularly around the June and July period.

Those same projections extend far beyond the current cycle, forecasting higher levels into 2030 and beyond. But near-term traders aren’t thinking in decades. They’re thinking in levels, liquidity, and survival, and right now the market is focused on whether XRP can stay above $1.50 without cracking.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

2 hours ago

13

2 hours ago

13

English (US) ·

English (US) ·