Retail investors are back in full force with Bitcoin (BTC), and this time, their demand surpasses what was seen in May 2020. This surge comes as BTC eyes the elusive $100,000 mark, a price level it has struggled to reach.

But is the return of retail demand enough to push Bitcoin to new heights? This on-chain analysis evaluates the potential impact.

Bitcoin Now Carries Everyone Along

Historically, Bitcoin’s price surged following an increase in retail demand, though whales and institutional investors have typically driven this current cycle.

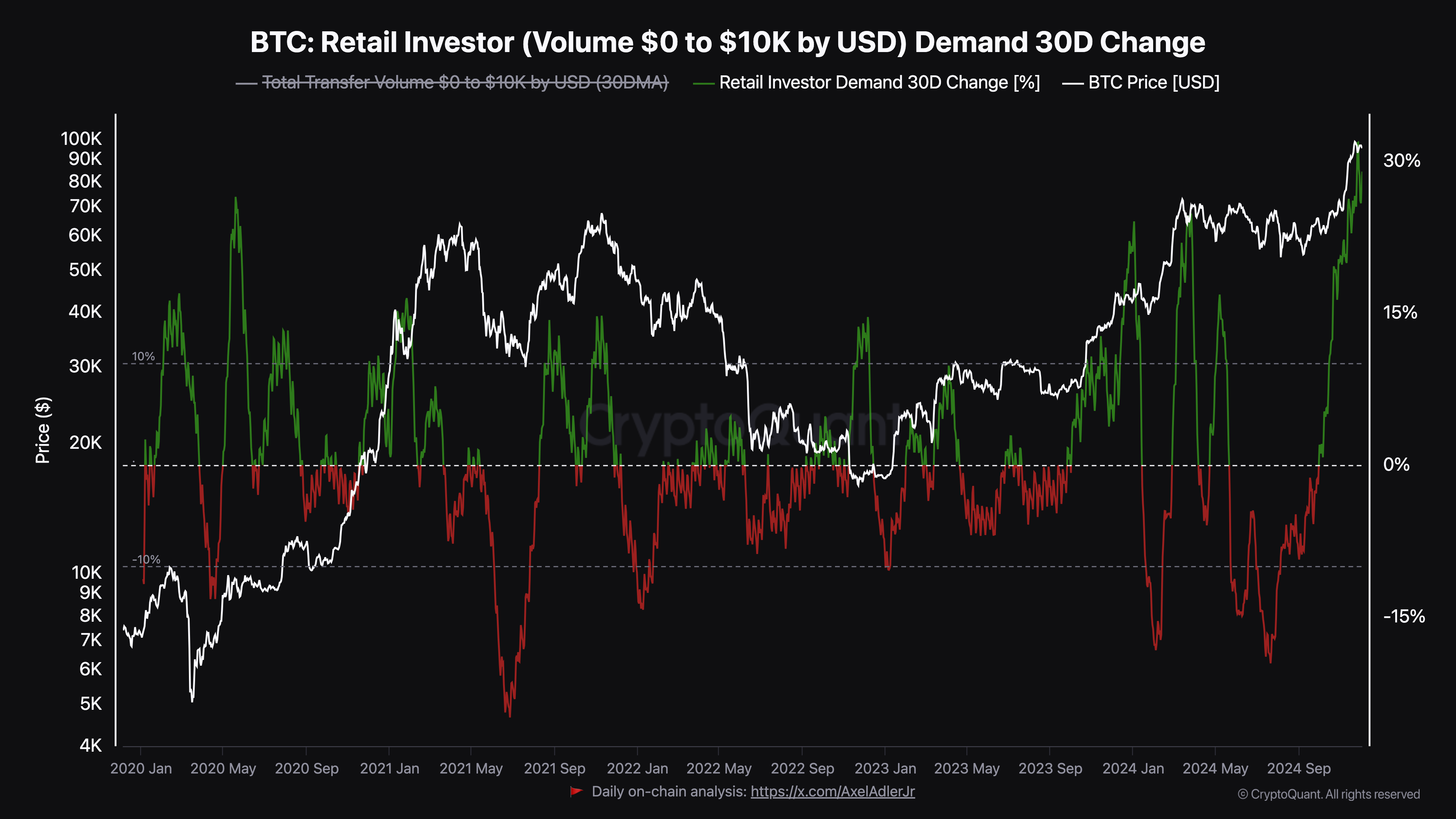

However, according to CryptoQuant, this trend may be shifting. Data from the 30-day retail investor demand metric reveals a significant change, tracking the flow of volumes under $10,000 into Bitcoin, suggesting a growing influence from retail investors

At press time, the metric reached $27.15, the highest level it has reached in over four years. The last time the reading neared this level, Bitcoin’s price climbed from $9,500 to $37,000 in less than six months.

Bitcoin Retail Investor Demand. Source: CryptoQuant

Bitcoin Retail Investor Demand. Source: CryptoQuant Therefore, if history rhymes, then BTC could rally to and surpass $100,000 within a few months. However, Darkfost, a pseudonymous analyst on CryptoQuant, opined that the run above $100,000 might not happen very fast.

According to the analyst, the hike in Bitcoin retail investor demand could signal a local top. In his post, Darkfost mentioned that the cryptocurrency could consolidate for a while before the uptrend returns.

“Bitcoin may continue to range for a while, with minor corrections, before making its next move upward to break the 100,000 psychological key. This breakthrough might reignite retail demand, potentially fueling a euphoric phase in the market,” the analyst explained.

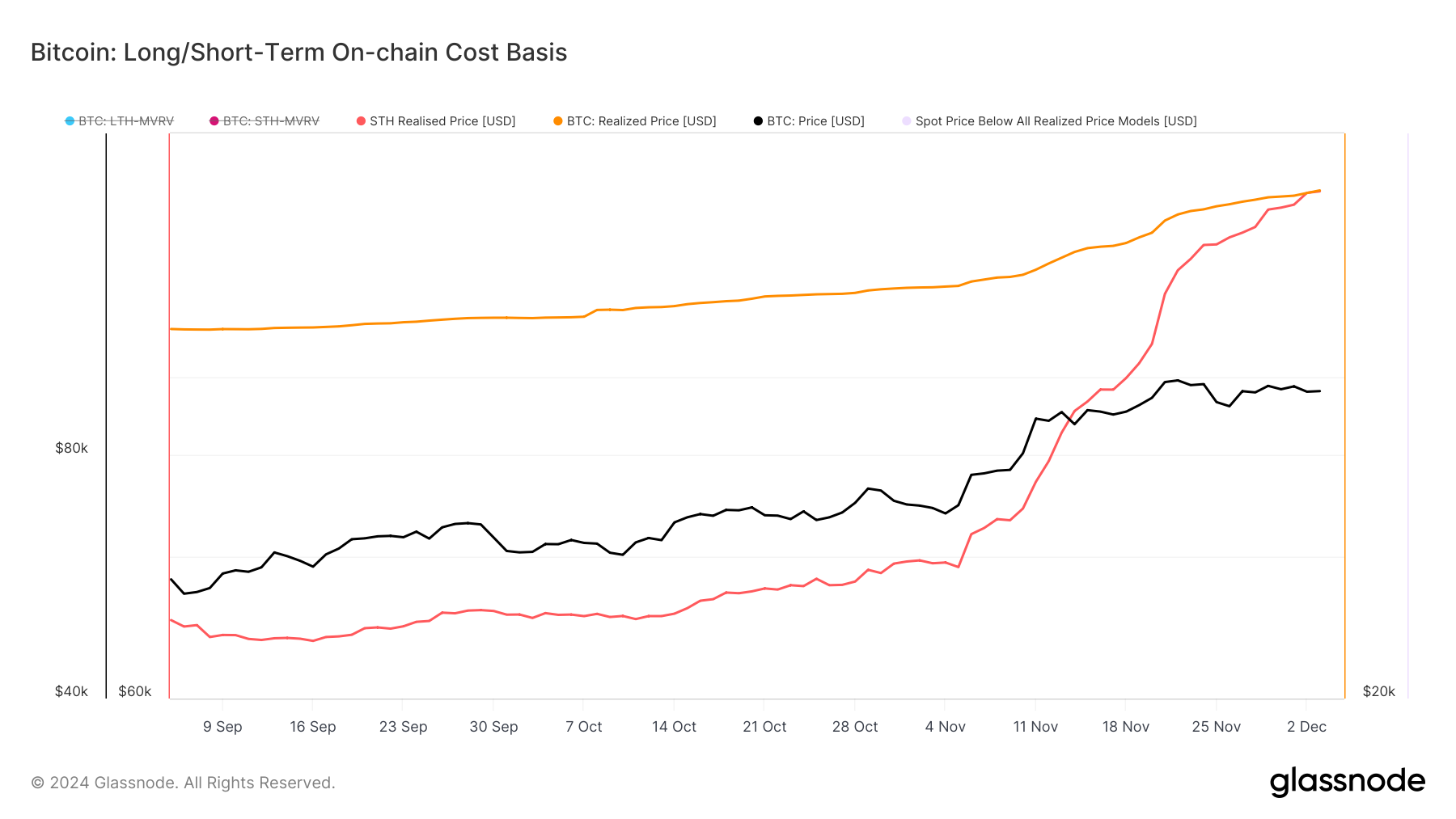

Moreover, data from Glassnode shows that Bitcoin’s short-term realized price, which is the average on-chain acquisition value, is $77,675.

Bitcoin Realized Price. Source: Glassnode

Bitcoin Realized Price. Source: Glassnode Typically, when the realized price is above Bitcoin’s market value, the trend is bearish. However, with BTC trading above $96,000, it suggests that the trend around the coin is bullish, and the price might increase.

BTC Price Prediction: $110,000 Possible in the Short Term

On the weekly chart, Bitcoin has formed a bull flag. A bull flag is a bullish chart pattern characterized by two strong rallies, separated by a brief consolidation phase.

The pattern starts with a sharp, almost vertical price spike, creating the ‘flagpole.’ This is followed by a pullback that forms parallel upper and lower trendlines, creating the ‘flag’ itself, as seen below.

Since BTC has broken out of the pattern, the coin’s price might hit higher values in the short term. If validated, Bitcoin’s price could climb to $100,274 soon. In a highly bullish scenario, it could rally above $110,000.

Bitcoin Weekly Analysis. Source: TradingView

Bitcoin Weekly Analysis. Source: TradingView On the other hand, if the demand for Bitcoin by retail investors drops, this prediction might not happen. In that case, the price might decrease to $90,275.

The post Bitcoin (BTC) Retail Boom Reaches 4-Year High, Rekindles Bullish Price Predictions appeared first on BeInCrypto.

2 months ago

27

2 months ago

27

English (US) ·

English (US) ·