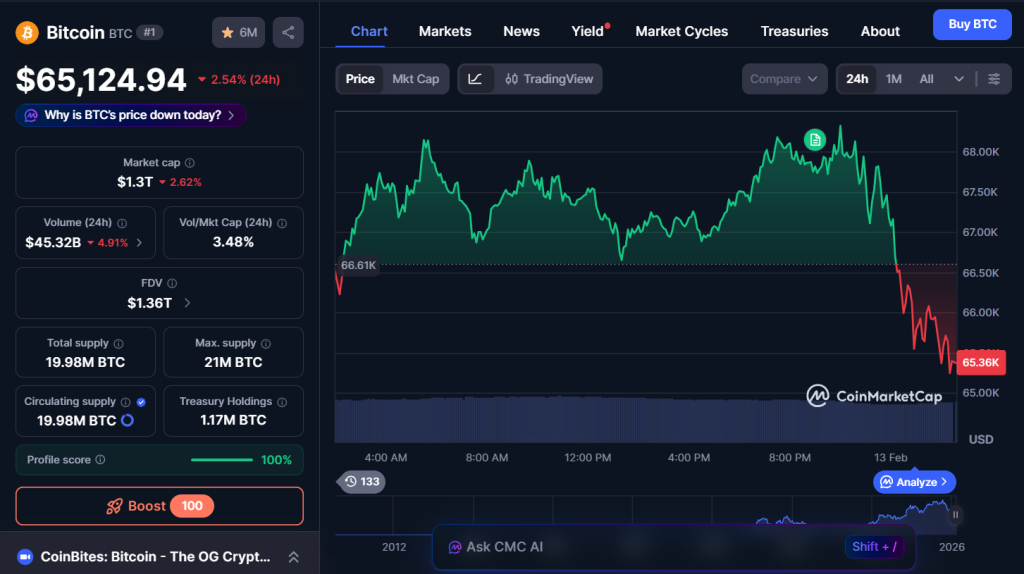

- Bitcoin fell 2% toward $66,000 as liquidations topped $280M in 24 hours

- Standard Chartered lowered both short-term and year-end crypto targets

- Open interest dropped to its lowest level since November 2024

Bitcoin slipped 2% on Thursday, sliding toward the $66,000 level by midday and weighing on the broader crypto market. Ethereum hovered near $1,900, Solana fell to around $78, and XRP dipped to $1.35. The overall market tone was cautious, with more red than green across major assets.

The move wasn’t explosive, but it was heavy. It felt like pressure building rather than panic breaking. And in this kind of tape, slow selling can sometimes matter more than sharp spikes.

Liquidations Rise as Leverage Pulls Back

According to Coinglass, more than $80 million in positions were liquidated in the past hour, with over $280 million wiped out across 24 hours. That’s not 2022-level chaos, but it’s meaningful enough to signal leverage is being trimmed.

More telling is the drop in open interest. Bitcoin open interest across exchanges has fallen to about $45 billion, its lowest level since November 2024. That suggests traders are closing positions rather than doubling down. When open interest falls alongside price, it usually signals de-risking rather than aggressive short building.

Standard Chartered Adds to the Pressure

The latest catalyst came from Standard Chartered, which cut both its short-term and year-end crypto forecasts. The bank now expects Bitcoin to fall toward $50,000 in the coming months and sees Ethereum potentially testing $1,400.

Geoff Kendrick, head of digital assets research at the firm, warned that ETF investors sitting on losses are more likely to exit than “buy the dip.” That comment hits directly at one of crypto’s most closely watched flows. If ETF holders reduce exposure instead of adding, liquidity becomes thinner and rebounds get harder.

The bank also revised its year-end targets lower: Bitcoin from $150,000 to $100,000, Ethereum from $7,500 to $4,000, Solana from $250 to $135, and BNB Chain from $1,755 to $1,050. The tone shift was clear. Optimism remains, but it’s tempered.

This Isn’t Just a Crypto Story

Broader markets were also under pressure. The S&P 500 fell nearly 1%, while the Nasdaq dropped 1.7%. Metals saw sharp selling, with gold down 2.4% to $4,960 and silver plunging 9% to $76.

When equities and metals slide alongside crypto, the narrative shifts from “crypto weakness” to broader risk repricing. In these moments, correlation rises, and asset classes move together whether investors like it or not.

Conclusion

Bitcoin’s drift toward $66,000 reflects fading risk appetite more than sudden panic. Liquidations are rising, open interest is falling, and institutional forecasts are being revised lower. Add in weakness across equities and metals, and the picture becomes clear: capital is stepping back.

Until macro sentiment stabilizes and ETF flows turn constructive again, rallies may struggle to hold. For now, the market feels less like it’s breaking and more like it’s unwinding.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

2 hours ago

12

2 hours ago

12

English (US) ·

English (US) ·