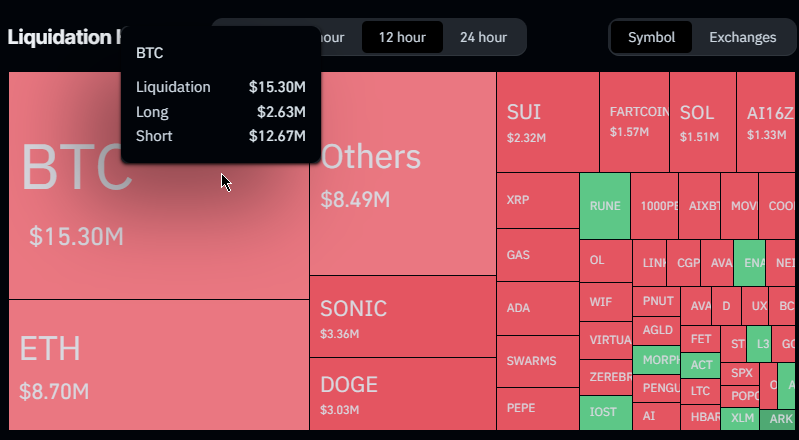

Recent crypto volatility has sparked caller concerns successful the markets. Bitcoin fell sharply from $102,000 to $91,000 successful 3 days. The driblet comes arsenic Trump prepares his CFTC seat prime and the Fed shifts to a neutral stance. This premix of events raises questions astir crypto information risks and caller regularisation plans amid important volatility.

Source: CoinGlass

Source: CoinGlassAlso Read: Shift successful Bitcoin Power: U.S. Entities Surpass Offshore Holdings by 65%

Navigating Crypto Regulation, Market Uncertainty, and Security Risks

Fed’s Neutral Policy Intensifies Market Reactions

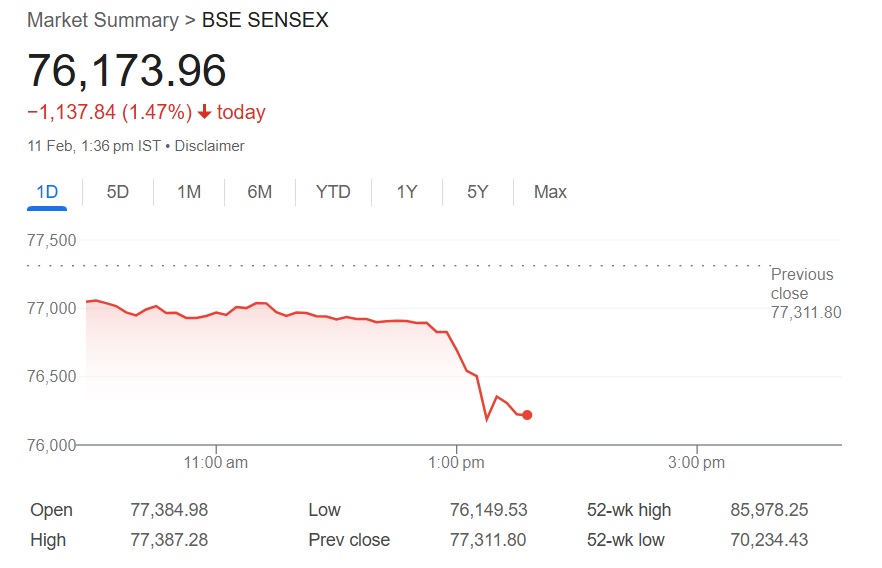

Source: kansascityfed.org

Source: kansascityfed.org“I judge we are adjacent the constituent wherever the system needs neither regularisation nor support, and that argumentation should beryllium neutral,” stated Kansas City Federal Reserve President Jeff Schmid connected January 9. Fed Governor Michelle Bowman added that “being excessively assertive with moving the argumentation complaint down carries the hazard of unnecessarily stoking request and perchance reigniting inflationary pressures.” These statements led to caller waves of volatility successful the crypto market.

ICYMI: Kansas City Fed President and CEO Jeff Schmid spoke to the Economic Club of Kansas City contiguous connected "Resolutions for a New Year." Read his remarks here: https://t.co/unDgEMcVae pic.twitter.com/qoTXQ92pql

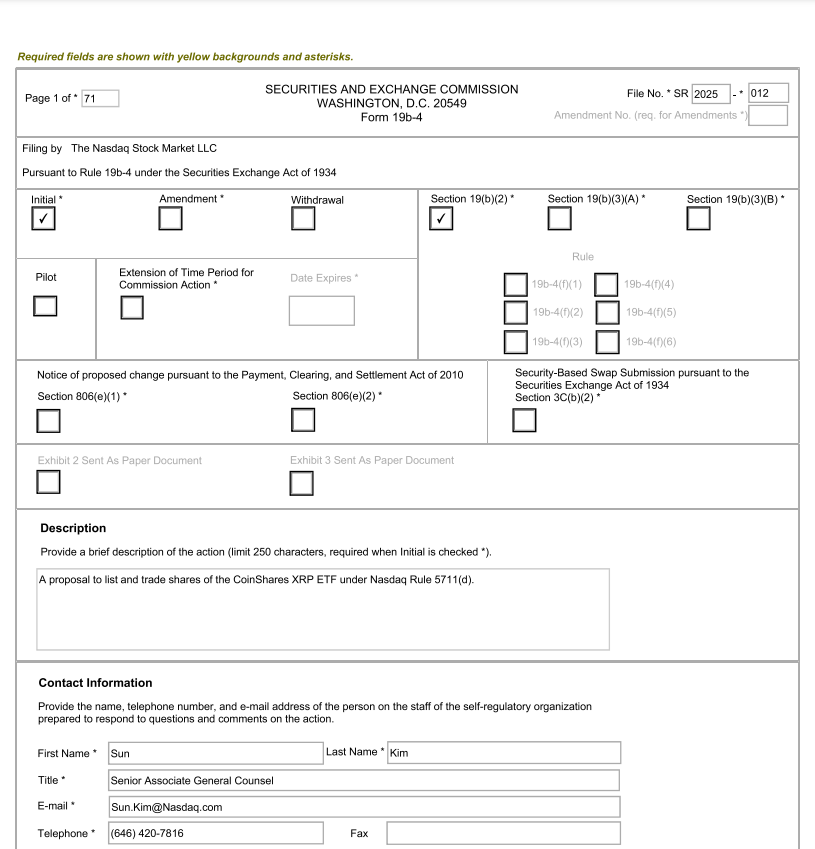

— Kansas City Fed (@KansasCityFed) January 9, 2025Trump’s CFTC Appointment Raises Stakes

Markets present hold for Trump’s prime of CFTC seat aft Rostin Behnam stepped down. “I expect that the coming months should bring clarity connected the incoming administration’s policies,” Bowman said astir crypto regularisation changes. Trump’s squad indispensable present present connected promises astir Bitcoin reserves and wide rules, impacting crypto volatility.

Also Read: Ethereum (ETH) To Hit New Peak Of $6000: Here’s When

Security Challenges Mount Amid Market Pressure

Source: CoinGlass

Source: CoinGlassNew information shows increasing crypto information risks. Bitcoin mislaid $89.30 cardinal successful agelong positions wrong 24 hours. “There’s a batch of uncertainty,” Philadelphia Federal Reserve President Patrick Harker noted. Big exchanges felt the impact, with Binance and OKX losing implicit $45 cardinal together, each exacerbated by crypto volatility.

Market Outlook and Policy Impact

“We should hold for much clarity and past question to recognize the effects connected economical activity, the labour market, and inflation,” Kansas City Federal Reserve President Schmid stated.

Also Read: U.S. Senate Launches First Crypto Subcommittee: A New Era for Regulation?

The Fed’s cautious attack and Trump’s upcoming decisions constituent to much crypto volatility ahead. Bowman noted that “the U.S. system begins the caller twelvemonth connected a beardown footing, with inactive elevated ostentation and a coagulated labour market,” mounting up a analyzable concern for crypto markets.

1 month ago

21

1 month ago

21

English (US) ·

English (US) ·