Analysts say the crypto market should brace for a wave of token unlocks totaling $17 billion by the end of April, raising concerns about devaluation and market saturation.

This follows a recent market event that saw nearly $10 billion in long liquidations, further straining liquidity.

TGEs and Market Saturation Spell Trouble for New Projects, Analysts Say

BeInCrypto reported on a historic crypto liquidation event provoked by US President Donald Trump’s tariffs. However, Bybit CEO Ben Zhou estimated that crypto liquidations after US tariffs could have been between $8-$10 billion, far exceeding reported figures.

Analysts now warn that the market is increasingly unwilling to support new execution environments that lack unique value propositions.

“The market can no longer absorb execution environments that add no value,” the analyst wrote.

While they cite post-token generation event (TGE) struggles among numerous projects, this perspective aligns with recent reports indicating crypto investors’ shifting focus from meme coins to altcoins with real-world value.

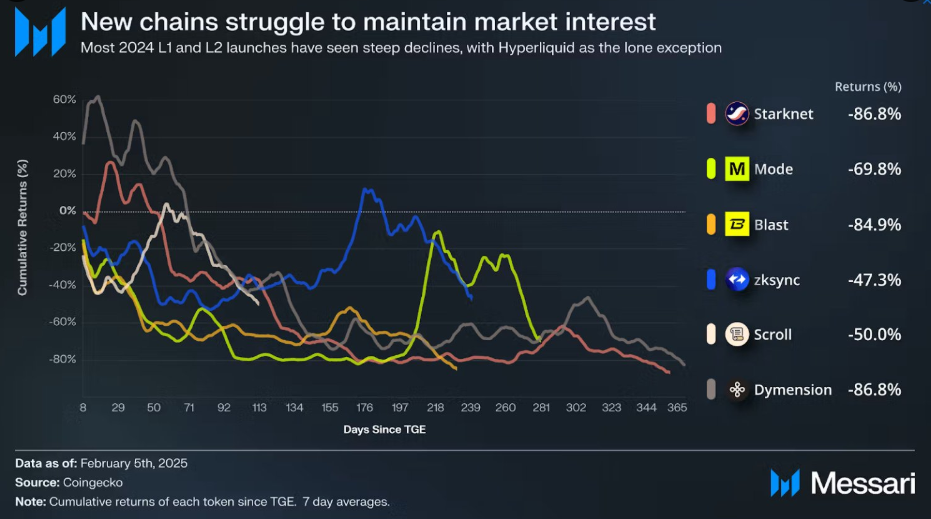

Citing Messari, a recent analysis by DeFi researcher Monk highlights the performance struggles of multiple blockchain projects post-TGE. Since their token launches, projects such as Starknet, Mode, Blast, zkSync, Scroll, and Dymension have experienced sharp declines.

Interest Among New Chains Post-TGE. Source: X

Interest Among New Chains Post-TGE. Source: XThe stark exception to this trend is Hyperliquid, whose HYPE token price has soared by 1100%. This highlights the rarity of success amid a sea of struggling chains.

Historically, large-scale token unlocks have hurt prices. A study by Keyrock Research found that 90% of token unlocks lead to price declines, as increased supply often outstrips demand. When vesting schedules release many tokens into circulation, early investors and insiders frequently cash out, intensifying selling pressure.

Arthur, founder and CIO of Defiance Capital, reinforces this perspective. He highlights significant declines in TVL (total value locked) among most of these chains after their token launches.

“This indicates not only weak token demand but also challenges in attracting and retaining users and liquidity,” Arthur added.

Analyst Explains Why New Chains Are Struggling

Notably, data on DefiLlama shows projects like Scroll and Blast have seen their TVL drop by more than 80% since their TGEs. The broader trend suggests that the market has an oversupply of blockspace.

According to the Defiance Capital executive, new Layer 1 (L1) and Layer 2 (L2) chains are increasingly having difficulty differentiating themselves. The challenge comes as established networks like Solana (SOL) and other prominent L2 solutions continue to thrive.

“The Solana Singularity. 2024’s crop of L1s and L2s launched, pumped, and plummeted. TVL drained; speculation faded, and zero sticky demand. Meanwhile, Solana just keeps winning,” another user, DefiBanked.sol on X, remarked.

The user emphasized that Solana’s strong fundamentals enable it to outpace newer chains. He cited Solana’s exceptional speed (400ms block times) and ultra-low transaction fees. According to the analyst, additional valuables on Solana include its thriving ecosystem spanning DeFi and NFTs, meme coins, and real-world assets (RWAs).

The struggles of recent blockchain launches reveal a growing intolerance for redundancy. Projects that fail to justify their existence will find themselves relegated to irrelevance. Meanwhile, established networks with strong utility, user adoption, and liquidity dominate.

Therefore, developers and investors must shift their focus toward innovation. New chains risk becoming just another casualty in an increasingly competitive space without a clear and compelling use case.

The post Devaluation Fears Rise as Analysts Predict $17 Billion in Token Unlocks by April appeared first on BeInCrypto.

6 months ago

41

6 months ago

41

English (US) ·

English (US) ·