- Solana hits major support with oversold indicators flashing early stabilization.

- Institutions keep accumulating, with nearly $98M in inflows this week alone.

- SOL remains the top chain in DEX activity and app revenue despite price pressure.

Solana’s latest slide has been testing everyone’s patience — dipping more than 10% in just 24 hours — yet a bunch of underlying signals keep hinting that the network’s real momentum hasn’t gone anywhere. SOL is now hovering around $123, landing right on a major support zone where buyers stepped in several times before. It’s one of those moments where the chart feels tense, almost like it’s waiting to see who steps forward first: bulls or bears.

On the daily chart, SOL is flashing clear oversold signs. The RSI has dropped to 32, its lowest reading in weeks, basically sitting on the edge of classic oversold territory. MACD momentum still looks bearish, too — no sugarcoating that part. But what makes this interesting is how the price is bouncing right at the lower edge of a long-term rising structure. That’s usually where bullish arguments quietly begin forming, even if sentiment looks shaky on the surface.

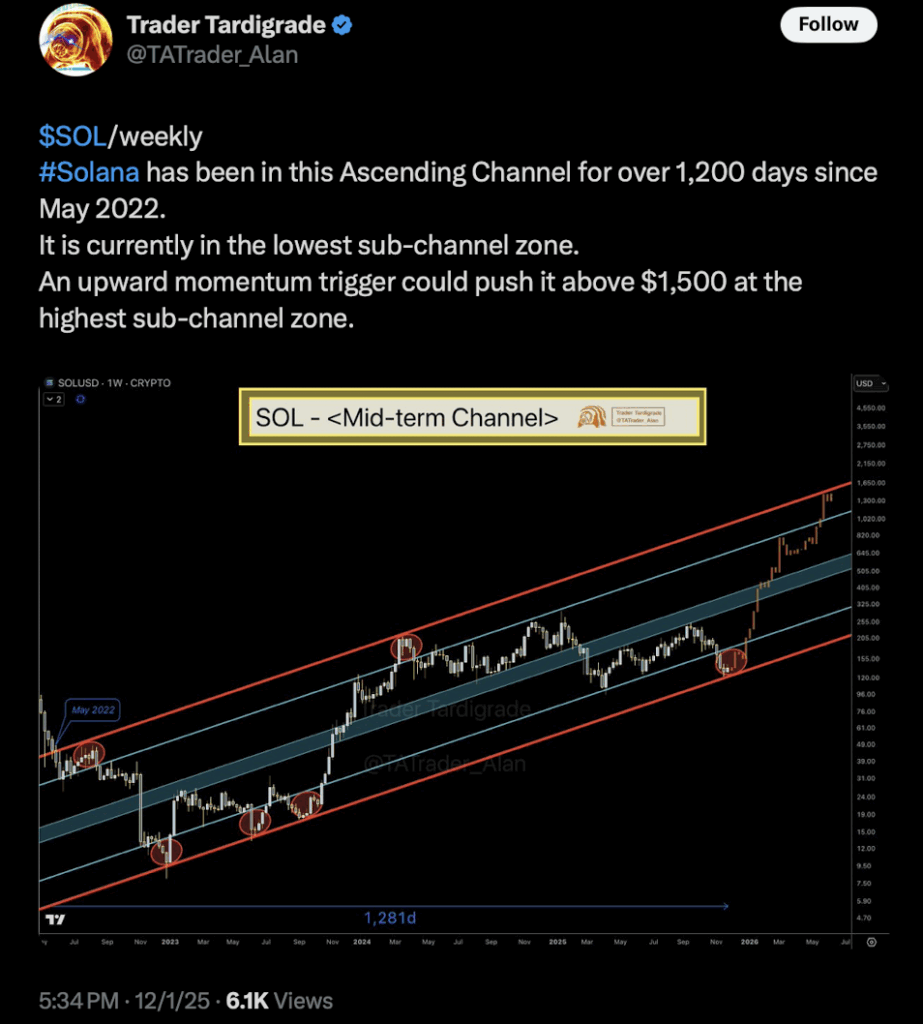

Solana Drops Into the Bottom of a Multi-Year Ascending Channel

Analyst Trader Tardigrade pointed out that Solana has stayed inside the same ascending channel for over 1,200 days — yeah, more than three years — dating all the way back to May 2022. According to his model, SOL just returned to the lowest sub-channel zone, the same region that sparked some of its biggest rallies in the past.

If Solana catches even a small lift from here, the upward trajectory could be powerful. The upper channel range — at its topmost level — even points toward a potential move above $1,500 if the long-term trend stays intact. Sounds insane when the price is sitting at $123, but technically, the structure supports it.

Institutions Keep Buying the Dip Like Nothing Happened

Even with the price pulling back, institutional interest hasn’t slowed at all. ETF inflows into Solana products are still climbing fast:

- +83,144 SOL in the past 24 hours (over $10.5M)

- +773,311 SOL across the last seven days (almost $98M)

This is the kind of steady accumulation that usually signals long-term positioning — not fear, not panic, and definitely not a market preparing for a collapse. Institutions tend to buy where they see long-term value, not short-term noise.

Solana Still Dominates On-Chain Activity

While the token price dips, the Solana ecosystem is doing the opposite — exploding with usage. Over the last 24 hours, Solana was the number-one blockchain in decentralized exchange volume at almost $3 billion, beating Ethereum, BNB Chain, Base, Polygon, Arbitrum… everyone. And it’s not just a one-day anomaly; Solana also leads the 7-day and 30-day windows for both DEX activity and app revenue.

Developers say this level of traffic creates a halo effect for new protocols. When the entire chain sits at the top of dashboards and analytics screens, new projects automatically land in front of more users and investors. Basically, the network’s visibility turns into free marketing.

What’s Next for SOL?

Solana is sitting right in that classic spot where strong fundamentals collide with short-term chart pain. Technically, SOL looks exhausted on the downside. ETF inflows show institutional confidence hasn’t budged. And the network itself continues to crush every other chain in usage metrics.

If buyers defend this support level and momentum flips even slightly, the long-term ascending channel stays intact — and history shows that rebounds from this exact setup have been sharp, sudden, and pretty dramatic.

Here is where patience might actually pay off.

The post Oversold Solana Nears Critical Rebound Zone With Strong ETF Inflows and Network Usage first appeared on BlockNews.

2 months ago

29

2 months ago

29

English (US) ·

English (US) ·