There is nary denying Shiba Inu’s (SHIB) unthinkable occurrence implicit the past 4 years. The asset’s terms has risen by a monolithic percent since its motorboat successful August 2020. During the 2021 bull run, the dog-themed cryptocurrency’s terms skyrocketed by galore cardinal percent. Early investors made large gains with minimal investments.

Also Read: Ethereum Price Prediction: ETH To Hit $4,000 by End of January?

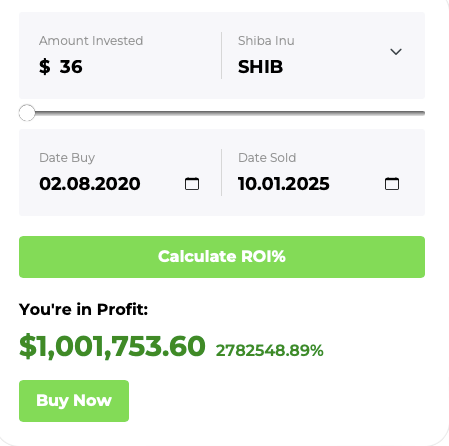

Just $36 In Shiba Inu Becomes $1 Million Today

Source: Watcher Guru

Source: Watcher GuruIf you had invested $36 successful SHIB connected Aug. 2, 2025, the concern would person been worthy much than $1 cardinal today. Your portfolio would person risen by 2,782,548.89% (2.78 cardinal percent).

Source: Changelly

Source: ChangellyAlso Read: Shift successful Bitcoin Power: U.S. Entities Surpass Offshore Holdings by 65%

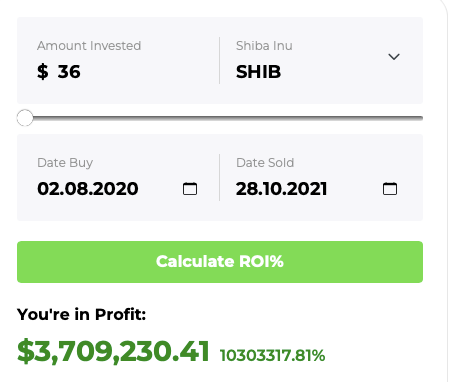

SHIB deed an all-time precocious of $0.00008616 connected Oct. 28, 2021. If you had sold your $36 worthy of SHIB erstwhile the plus was astatine its peak, your concern would person been worthy $3.7 million. In this scenario, your portfolio’s worth would person risen by 10,303,317.81% (10.3 cardinal percent).

Source: Changelly

Source: ChangellyWhy Did The Asset Rally So High In 2021?

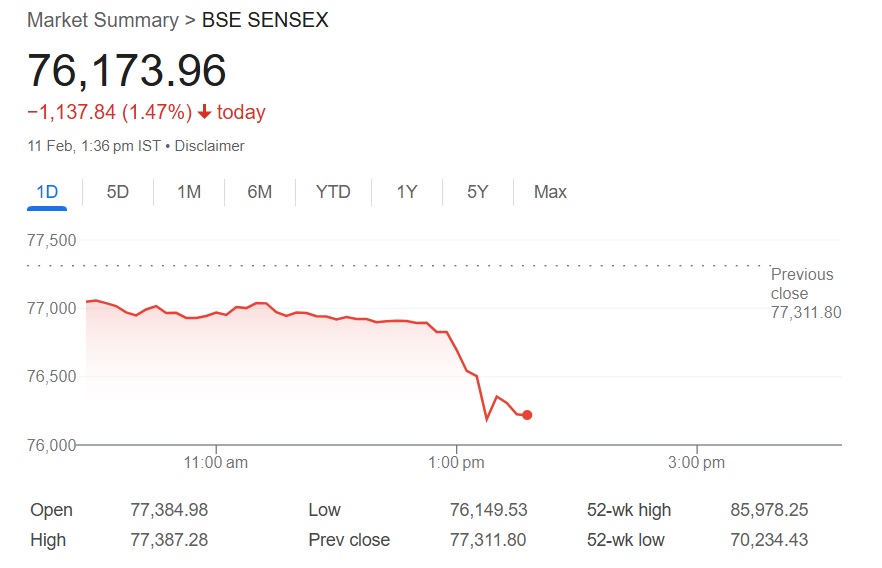

Source: Watcher Guru

Source: Watcher GuruOne of the astir important reasons for SHIB’s unthinkable 2021 rally was Vitalik Buterin’s monolithic token burn. Buterin received fractional of the SHIB proviso upon launch. The Ethereum co-founder decided to pain 90% of the tokens helium received and donate the remainder to charity. His actions led to a important dip successful proviso portion request was high. The improvement led to a important terms spike for SHIB.

Also Read: Top 3 Cryptocurrencies You Should Watch This Weekend

Shiba Inu (SHIB) inactive has astir 589 trillion tokens successful circulation. The monolithic proviso is 1 of the astir important barriers to the asset’s price. If the task tin undertake different 2021-like pain portion keeping request high, we whitethorn witnesser different monolithic terms spike for the asset. The SHIB squad is reportedly moving connected a caller pain mechanism, rumored to pain trillions of tokens yearly. We are yet to cognize erstwhile the caller pain mechanics volition launch.

1 month ago

24

1 month ago

24

English (US) ·

English (US) ·