Solana (SOL) has recently experienced significant price action, reaching an all-time high (ATH) of $264 before seeing a pullback. Currently trading around $233, the altcoin has found stability above the $221 support level.

With Bitcoin’s recent price surge, Solana could benefit as the market leader’s breakout may spark a positive ripple effect across the altcoin market.

Solana Shows Bullish Signs

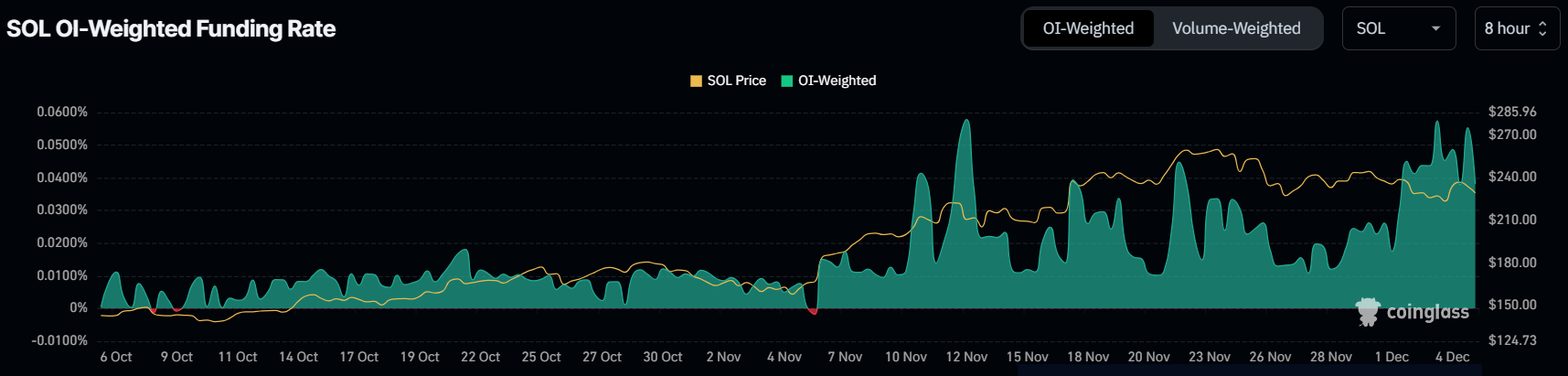

The funding rate for Solana is currently highly positive, a key indicator of bullish sentiment in the market. A positive funding rate suggests that traders are willing to pay to keep their long positions open, reflecting optimism toward Solana’s price performance.

Despite recent volatility, this sustained confidence in SOL’s potential for price gains indicates that traders are anticipating a strong upward move in the near term.

Traders’ optimism is further fueled by Solana’s ability to hold its ground amid fluctuations. As the market remains volatile, the willingness to support SOL with long positions signals that investors are betting on its recovery and long-term growth.

Solana Funding Rate. Source: Coinglass

Solana Funding Rate. Source: CoinglassSolana’s correlation with Bitcoin (BTC) has recently dropped to a low of 0.43. This lower correlation is viewed positively by many market analysts, as Solana has historically seen price surges every time its correlation with Bitcoin decreases.

The reduced correlation means that SOL could start to decouple from BTC’s movements, enabling it to rally on its own merits rather than mirroring Bitcoin’s price swings. This decoupling may allow Solana to outperform Bitcoin, as altcoins often benefit from periods of reduced correlation with the market leader.

Solana Correlation to Bitcoin. Source: TradingView

Solana Correlation to Bitcoin. Source: TradingViewSOL Price Prediction: Aiming For the Highs

Solana’s current price is $233, caught in a consolidation zone between $245 and $221. A breakout above the $245 resistance would signal a return to bullish momentum for SOL, potentially pushing it toward $270. This move would confirm that the market is ready to support Solana’s rise to a new all-time high beyond $264.

However, if SOL fails to break the $245 resistance and drops below $221, it could test the $200 support level. A sustained decline would undermine the bullish outlook and signal further consolidation or downside risk for Solana.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingViewWith Bitcoin’s bullish trend pushing the overall market upward, Solana is poised to capitalize on this momentum. If it successfully breaks out of its consolidation phase, SOL could quickly rise to $270. However, any failure to hold above $221 would shift the market sentiment to a more cautious stance.

The post Solana Finds Footing Above $221, Bullish Breakout Could Challenge Previous Highs appeared first on BeInCrypto.

2 months ago

31

2 months ago

31

English (US) ·

English (US) ·