- Solana fell to $85.73 after a 26% weekly drop, with volume surging above $13B

- The break below $100 POC and the $128–$150 range signals a major bearish structure shift

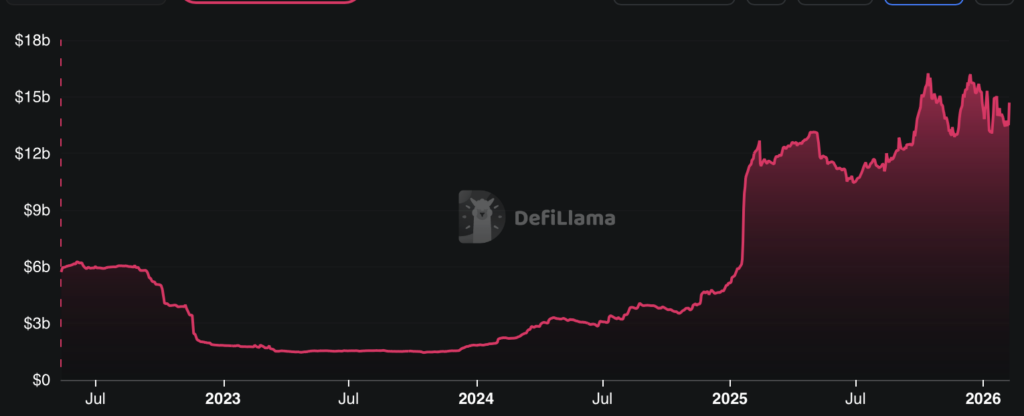

- Despite the sell-off, Solana’s RWA ecosystem surpassed $1B and added instant redemption tools

Solana slipped to $85.73 on Friday, February 6, 2026, extending a brutal weekly decline of roughly 26.5%, according to CoinMarketCap data. What really stood out wasn’t just the price drop, but the activity behind it. Trading volume surged over 49% to around $13.34 billion, showing that this move wasn’t happening quietly. The market was active, aggressive, and pretty emotional.

Technically, SOL also broke decisively below its January 2024 consolidation range between $128 and $150. That breakdown matters because it signals a structural shift, not just another dip. When price loses a long-held range like that, it often takes time to rebuild, and the selling pressure tends to stay sticky.

SOL breaks below the $100 point of control

In a post on X, analyst Umair Crypto pointed out that Solana’s fall below the $100 Point of Control triggered an approximate 27% sell-off. After that, price managed only a small bounce before drifting toward the $73 to $67 support zone. According to Umair, the key detail is the relationship between price and volume.

Price is pulling back while volume expands, which usually signals downside conviction rather than a quick V-shaped recovery. That’s the kind of tape action that makes traders cautious. Even if SOL bounces, analysts warn that it may be corrective, not the start of a new uptrend.

From a technical standpoint, SOL is trading well below key moving averages across short-, medium-, and long-term timeframes, and those averages are sloping downward. That’s the definition of a trend that’s still in control. The fact that the breakdown happened on rising volume also suggests institutional involvement, meaning the recent decline may be driven more by large-scale selling than retail panic alone.

Oversold RSI doesn’t guarantee a real bounce

Momentum indicators show SOL is now deeply oversold. RSI has dropped below 30, which can sometimes trigger short-term relief rallies. But oversold conditions don’t automatically mean the bottom is in. In strong downtrends, RSI can stay pinned for longer than most traders expect, and bounces often get sold into.

Analysts note that volatility is likely to remain elevated until SOL finds acceptance in new high-volume zones, particularly around $73 and $57. Those are the areas being watched as potential “reset” levels where the market might finally stabilize, or at least pause.

Solana’s RWA ecosystem keeps expanding despite the sell-off

Interestingly, while price action has been ugly, Solana continues pushing forward on the real-world asset side. According to a press release, Multiliquid and Metalayer Ventures launched an instant redemption facility for tokenized assets on Solana. The goal is simple but important: allow holders to convert tokenized positions into stablecoins 24/7, without waiting on slow liquidity windows.

This tackles a major bottleneck for institutions. One of the biggest issues with tokenized private credit, equity, and real estate is that exits are often unpredictable. A redemption facility like this offers a cleaner path out, which makes the entire market more usable for serious capital.

The facility, operated with support from Uniform Labs and the Multiliquid protocol, dynamically prices redemptions below net asset value. That approach prioritizes speed while still compensating liquidity providers, which is basically the trade-off institutions care about most. Fast exits, predictable pricing, and no drama.

Solana’s RWA market has now surpassed $1 billion, including tokenized assets from issuers like VanEck, Janus Henderson, and Fasanara. Nick Ducoff, Head of Institutional Growth at the Solana Foundation, emphasized that reliable redemption capacity is critical infrastructure for tokenized markets and strengthens Solana’s position as a hub for issuance, trading, and exit solutions.

What traders are watching next

Right now, SOL is stuck in a difficult spot. The chart is bearish, volume is rising, and the breakdown below key ranges has changed the market structure. At the same time, development on the RWA side is moving forward, showing that the ecosystem itself hasn’t stopped building, even while price bleeds.

In the short term, the focus remains on whether SOL can hold and stabilize near $73 to $67. If that zone fails, the next major area of interest sits closer to $57. Until SOL builds a base again, rallies may continue to look more like relief bounces than true recoveries.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

2 hours ago

14

2 hours ago

14

English (US) ·

English (US) ·