- Solana is down about 12% on the month, with January history favoring a rebound but no confirmation yet.

- ETF inflows remain steady, though demand is selective rather than market-wide.

- $129 is the key upside pivot, while a drop below $116 would invalidate the bullish January setup.

Solana has had a rough close to the year, down roughly 12% over the past 30 days as selling pressure lingered through December. With 2026 approaching, the chart doesn’t offer a clean answer yet. Some indicators hint that a bounce could arrive in January, while others warn that downside pressure may stick around if buyers fail to show up soon.

This kind of setup isn’t unusual for SOL. The asset has a habit of testing patience late in the year, only to surprise traders once the calendar flips, though that pattern isn’t guaranteed, especially in a more selective market.

History Favors January, but Flows Tell a Narrow Story

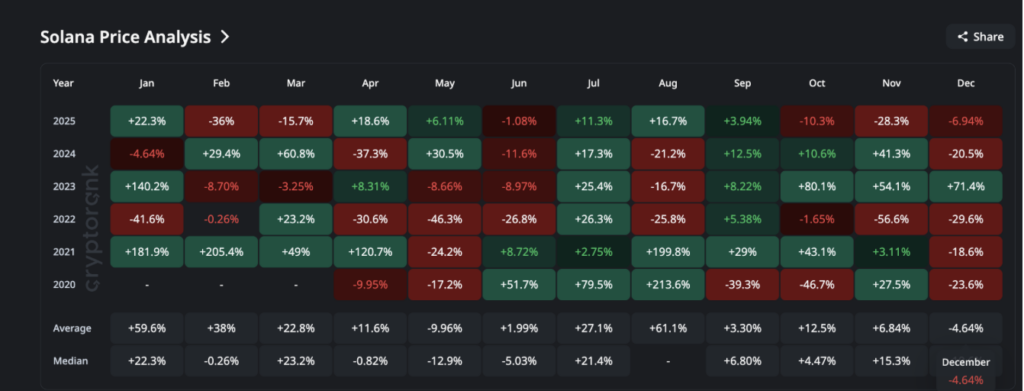

Historically, January has been one of Solana’s strongest months. Average returns sit near 59%, with median gains around 22%, and the pattern becomes more pronounced when December closes red. In 2022, SOL fell nearly 30% in December, only to rally 140% in January 2023. A similar rhythm played out last year as well. With SOL down again this December, the stats lean toward another rebound.

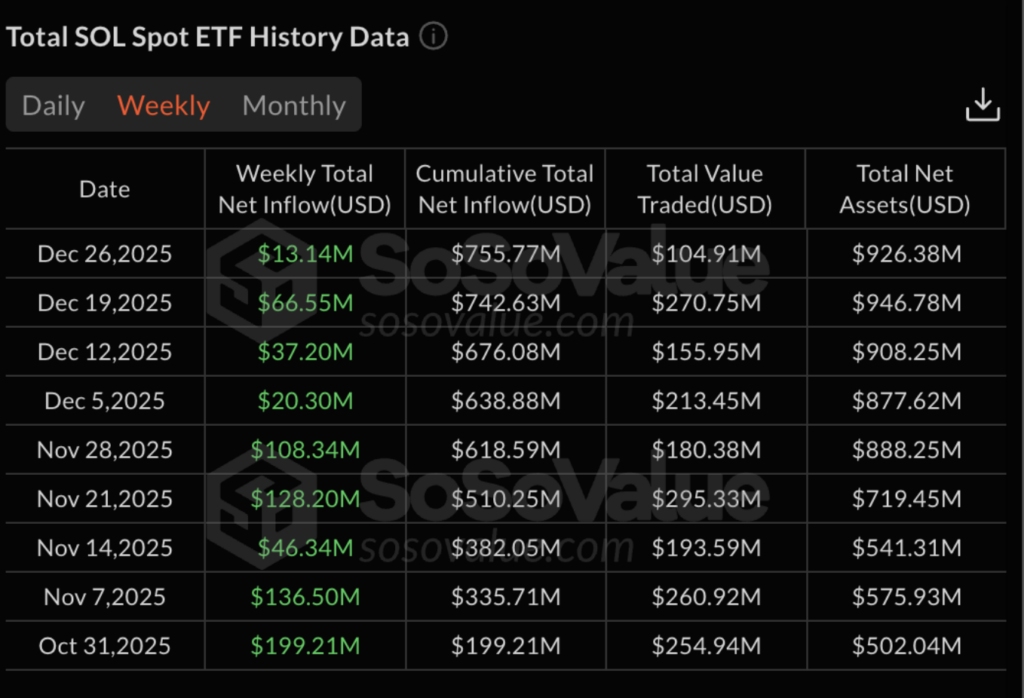

ETF flows add some support to that idea, though with a caveat. Since launch, Solana spot ETFs have yet to record a single week of net outflows. The most recent week added roughly $13 million, bringing cumulative inflows to about $755 million. That steady demand suggests confidence, but it’s narrow. Analysts at B2BinPay noted that investors are not rotating broadly into altcoins, instead favoring a small group of liquid names like Solana or XRP, where risk feels more manageable.

Bullish Divergence Appears, but Trend Risk Remains

On the two-day chart, Solana printed a lower low between late November and mid-December, while RSI formed a higher low. That bullish divergence often shows up near early reversal zones, assuming buyers follow through. Momentum, at least on that front, looks like it’s trying to turn.

Right beside that signal, however, sits a warning. The 100-period EMA is close to crossing below the 200-period EMA, a bearish setup that tends to weigh on price. If that crossover confirms, downside pressure could extend into early January before any recovery can really stick. Until that risk clears, the technical picture stays split, not broken, but not convincing either.

Derivatives Positioning Reflects Caution

Derivatives data leans cautious for now. On Hyperliquid, most trader groups, including top addresses and whale accounts, remain net short over the past week. That suggests hesitation rather than outright panic. At the same time, a few cohorts, like smart money and some public figures, have begun opening small long positions.

That mix points to expectation, not confirmation. Traders appear to be positioning for a potential January move, but they aren’t committing heavily yet. For SOL to build a real rally, that derivative bias would need to flip away from shorts, ideally alongside improving spot momentum.

Key Levels Will Decide the January Story

SOL currently trades near $124, sitting inside a dense supply zone highlighted by cost-basis data. The $129 level is the pivot. A two-day close above it would clear a major supply cluster and open room toward $150, with $171 coming into view if momentum and ETF inflows hold. Above $129, resistance thins out quickly, but only if volume shows up.

On the downside, $116 remains the fail-safe. Losing that level would break the familiar “red December, green January” pattern and likely confirm continuation lower, especially if paired with a bearish EMA crossover. For now, Solana is boxed between these thresholds, waiting for a decisive push.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

1 month ago

22

1 month ago

22

English (US) ·

English (US) ·