- SUI sits on a long-term support zone that previously triggered major rallies.

- Momentum indicators show weakness but early hints of stabilization.

- Ecosystem growth, including new DeFi platforms, strengthens long-term outlook.

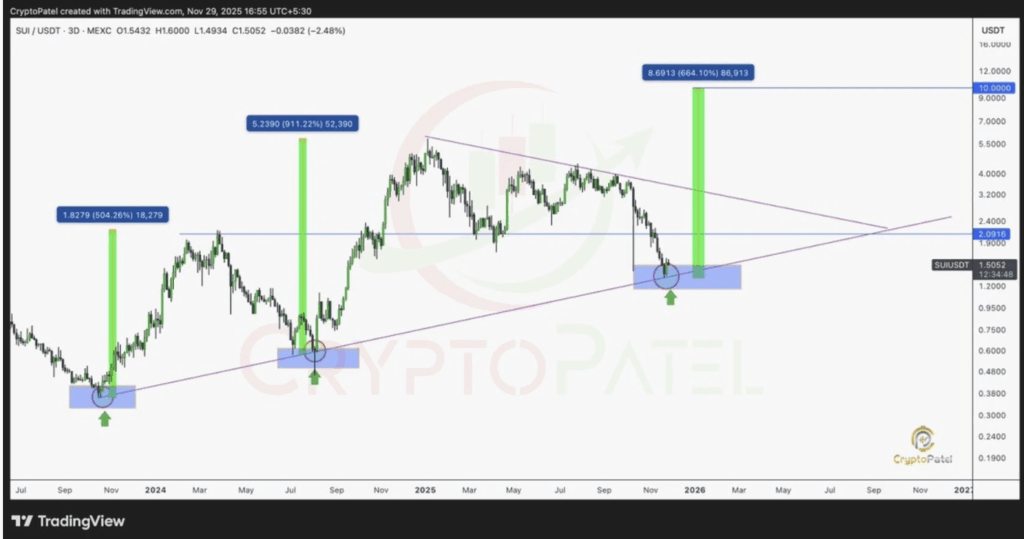

SUI is hovering around $1.55 right now, pressing right against a long-term ascending support line that has triggered some pretty huge rallies in the past. The price has slipped into that strong demand zone between $1.30 and $1.60 — an area where buyers have historically reacted fast and, honestly, pretty aggressively. As long as SUI keeps holding above roughly $1.40, the overall structure stays intact, leaving the door open for a high-timeframe reversal that could stretch over the next few weeks or even months. It’s one of those spots where things feel tense but also kinda full of potential.

Resistance Levels That Could Trigger a Larger Breakout

For the bullish scenario to actually confirm itself, SUI has to reclaim resistance at $2.09. That’s the immediate hurdle. After that, the big test sits around the descending trendline near $2.40–$2.60. Clearing this zone opens mid-term targets at $3.20 and $4.00 — levels that acted as important pivot zones in previous cycles. If momentum really kicks in, the structure even points to a macro extension target near $10.00, which sounds wild at first, but lines up with the broader continuation pattern forming on the chart. It’s basically a high-probability long-term setup if buyers step in with actual conviction.

What Happens If Support Breaks?

If SUI slips beneath the ascending support line, the first breakdown danger zone is $1.40. Losing that would invalidate the bullish setup, sending the price toward the next major support at $1.00–$1.10. Buyers might attempt a rebound there, but if that fails, the chart leaves room for a deeper correction all the way down to around $0.80 — the capitulation zone that usually acts as a last line of defense before structural failure. It’s not the preferred scenario, obviously, but it’s still on the table.

Momentum Weak but Showing Early Signs of Stabilizing

The RSI sits at 35.31, which puts SUI close to oversold territory. That typically signals persistent bearish pressure, but the curve is slightly curling upward — a quiet hint that selling momentum might be losing steam after such a long downtrend. The MACD remains deeply bearish, with the MACD line below the signal line and both stuck in negative territory. The histogram bars are shrinking though, which means the speed of the decline is slowing. No bullish cross yet, but the selling impulse isn’t as sharp as before—kind of like the market slowly exhaling.

Sui’s Ecosystem Expansion Could Boost Long-Term Confidence

Fundamentally, Sui’s ecosystem is still expanding even while the price cools down. A new platform, @AftermathFi, has launched to support on-chain derivative trading, strengthening Sui’s growing DeFi environment. And in a recent livestream, @0xairtx explained why they chose the Sui chain for building their perpetual trading product: reliability, performance, and architecture were the standout reasons. It’s the kind of behind-the-scenes development that often fuels long-term growth even when charts look messy in the short term. Here is where SUI’s future might quietly be setting up, even if the price hasn’t caught up yet.

The post Sui Ecosystem Growth Meets Oversold Technicals at Long-Term Support — Here is Why This Zone Matters Now first appeared on BlockNews.

2 months ago

26

2 months ago

26

English (US) ·

English (US) ·