According to new on-chain data, Tether just minted USDT tokens worth $1 billion. The company has recently been minting in huge volumes, reporting record profits in Q3 2024.

However, Binance and Circle announced a partnership today to possibly take on Tether, marking a potential new major rival to the company’s stablecoin market share.

Tether Mints Huge Volumes of USDT

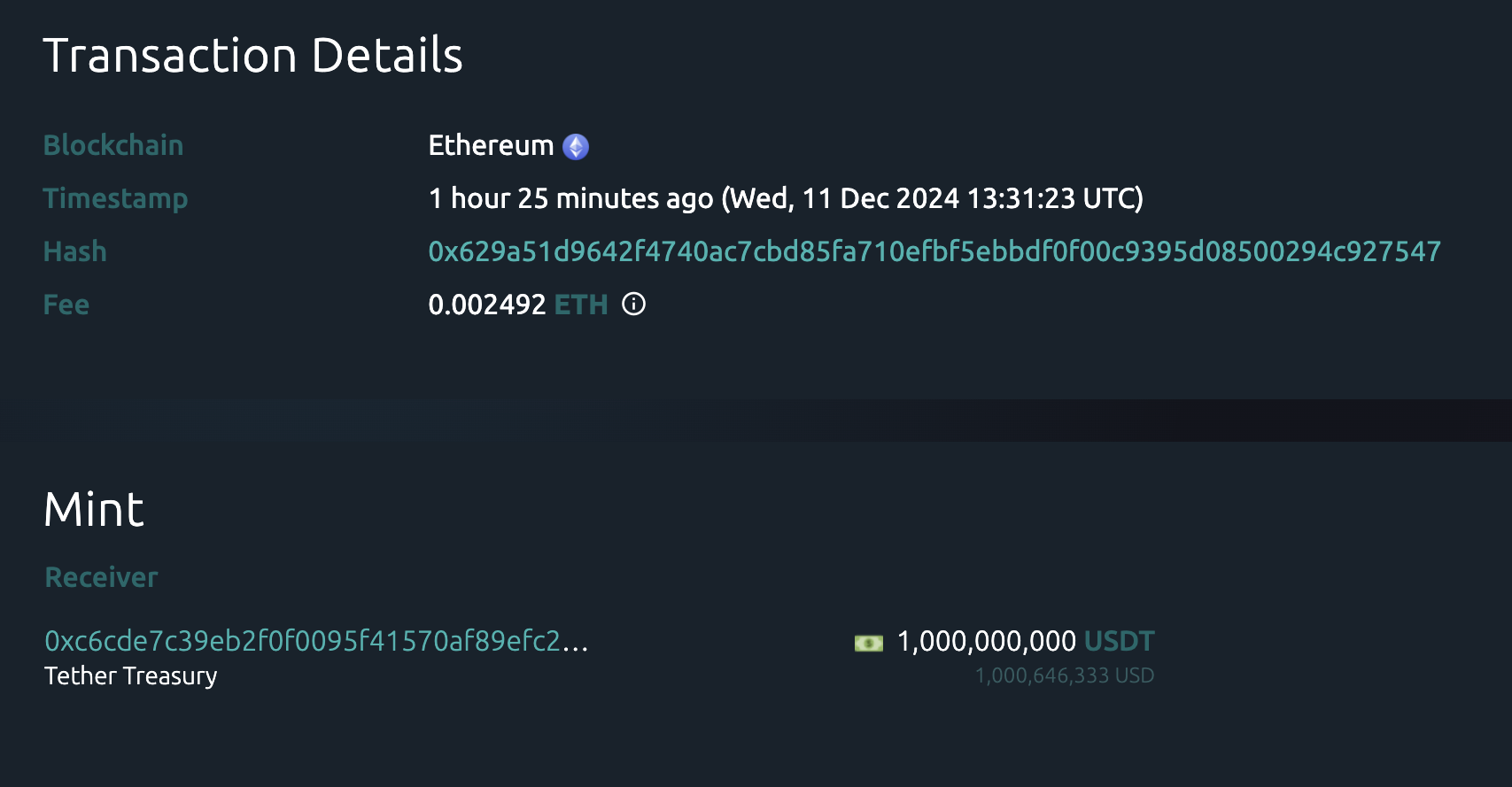

On-chain data reports from December 11 show a massive new minting of USDT tokens. However, this isn’t unusual for one of the world’s leading stablecoins. Tether has been minting abnormally high amounts of USDT lately, with 2 billion on December 6 and 19 billion in the last month.

Image: Tether Mints 1 Billion USDT Tokens. Source: Whale Alert

Image: Tether Mints 1 Billion USDT Tokens. Source: Whale AlertOverall, the firm has been performing positively throughout the current bull market, continuing its relative dominance over the broader stablecoin market. The latest earnings report revealed that it reached record profits in Q3 2024, with soaring demand for USDT.

Also, this success extends to regulatory victories. Earlier this week, the Abu Dhabi Global Market approved USDT as an Accepted Virtual Asset.

However, the firm still faces several hurdles that might have prompted this token minting. Coinbase will delist Tether in the EU this December due to concerns about noncompliance with the new MiCA regulations. Tether has already taken moves to reduce exposure in Europe.

Meanwhile, competitors like Robinhood and Revolut are also considering new stablecoins to take advantage of Tether’s decline in the EU market. In the US, Ripple has also received a regulatory greenlight to launch its RLUSD stablecoin.

Still, some social media rumors have connected this minting to an even bigger potential problem for the company. According to reports, Binance and Circle announced a new partnership to use USDC to take Tether’s market share. Circle’s USDC token is jointly owned by Coinbase, marking an alliance between two major exchanges with a longstanding rivalry.

“Binance has undergone a deep transformation of its business, and over time, we mutually agreed that it made sense to pair one of the world’s most trusted and regulated stablecoins,” claimed Kash Razzaghi, Circle’s Chief Business Officer.

Still, this partnership is very new, and Tether has been minting abnormally high USDT volumes for the past month. If the firm is preparing to carry out a new rivalry, it’s in the early stages. In any event, there’s not enough definitive information to speculate on Tether’s future trajectory.

The post Tether Mints $1 Billion in USDT As Binance and Circle Challenges Market Share appeared first on BeInCrypto.

1 month ago

28

1 month ago

28

English (US) ·

English (US) ·