- Whale transactions have dropped sharply, weakening DOGE’s short-term strength.

- Retail is dominating Futures trading while whales accumulate slowly on Spot.

- Historical patterns hint at a possible rally if broader market conditions improve.

Dogecoin has been wobbling a bit, dropping under the $0.15 line while somehow still hanging onto its top-10 spot in the market. The last week of November looked pretty bullish for most major assets, yet DOGE only managed to crawl up around 4% — not terrible, but definitely not the kind of move that excites a memecoin crowd. With its market cap sitting near $22 billion, the chain’s recent on-chain behavior seems to give some clues about why things feel sluggish. Funny enough, old comments from Vitalik Buterin praising Dogecoin have resurfaced, adding a weird nostalgia undertone to the current dip. But the real question is lingering: is DOGE gearing up for a bounce, or is this just the start of another slide?

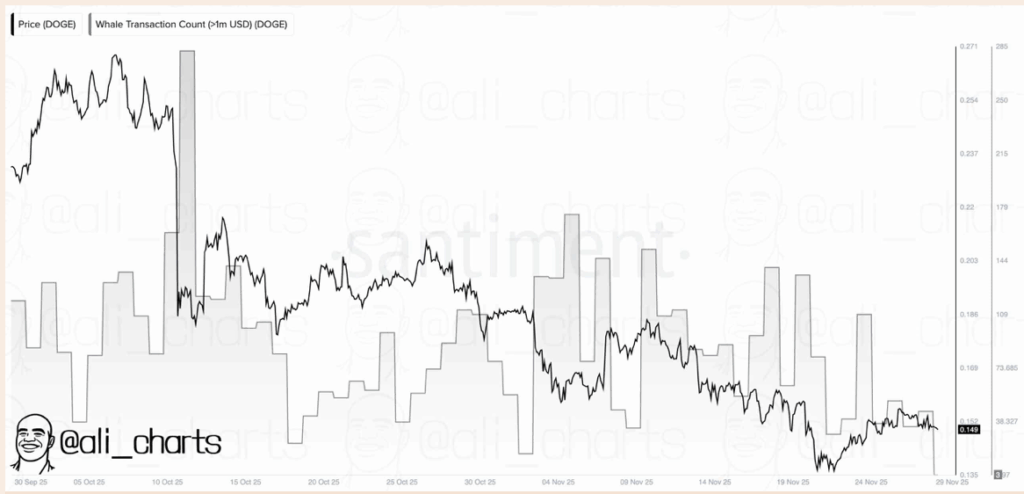

Whale Activity Drops to Concerning Lows

According to Santiment, Dogecoin’s whale transactions — specifically those involving over $1 million positions — have fallen off a cliff in the last two months. They dropped from about 285 down to under 38, which is a pretty dramatic slowdown. When whales and big institutions step back, liquidity weakens and prices tend to drift or pull back. That explains why DOGE hasn’t been able to reclaim those pre-election 2024 levels during the recent two-month retracement. The price, overlaid on the same chart, has fallen from $0.271 all the way down to $0.13 at one point. Historically, drops like this have sometimes marked major turning points… but only if other signals line up with it.

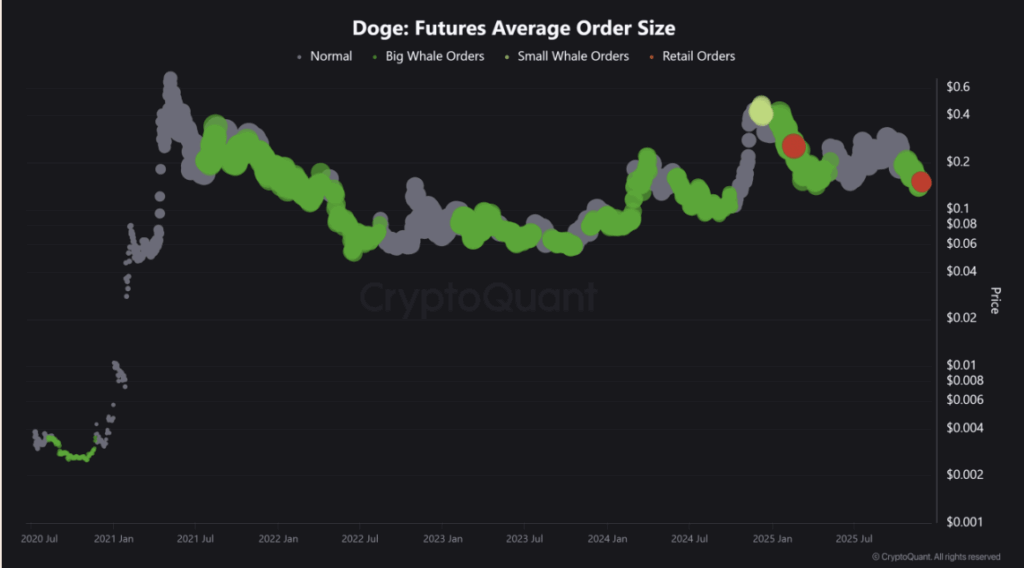

Retail Dominates Futures While Whales Slowly Accumulate

CryptoQuant’s data paints a slightly more complicated picture. While whales have backed off from Futures activity, they’re still active on Spot — which usually hints at accumulation. But the accumulation seems slow and careful, not the kind of aggressive buying that pushes the price sharply higher. Meanwhile, Futures positions are crowded with retail traders, which explains part of the sluggish price action. Retail just doesn’t have the capital firepower to move DOGE meaningfully on its own. Sentiment readings show that futures traders were bearish with a score of 1.31, basically signaling they were selling into the weakness. Smart Money, although small in number, leaned faintly bullish, which just adds another layer of mixed signals.

Could Dogecoin Stage a Surprise Rally?

Technically, Dogecoin did break below a key price level, but here’s where things get interesting — historical data from Q4 2024 shows that when DOGE broke below the same two-touch support, the next move was actually a rally. Analyst Trader Tardigrade pointed out a similar pattern forming now, suggesting DOGE could “pump” and possibly even push past $0.60 if conditions line up. But all of this still depends heavily on the broader crypto market. The entire space has been struggling, and DOGE hasn’t been an exception, though the retreat in both price action and on-chain activity might be getting close to the point where reversals tend to appear. Here is where the next few weeks could decide whether this dip was exhaustion… or just the calm before a stronger move.

The post Will DOGE Repeat Its Historical Pump After This Deep Retrace? — Here is. first appeared on BlockNews.

2 months ago

28

2 months ago

28

English (US) ·

English (US) ·