- XRP falling below realized price suggests most holders are now underwater, increasing sell risk

- MVRV, NUPL, and realized cap metrics point to weakening demand and capital outflows

- Weekly structure remains bearish, with $1.70–$1.85 as resistance and $1.00–$0.95 as key support

XRP dropped below its Realized Price on February 5, trading near $1.25, a move that often signals bears are starting to take control. Realized Price represents the average cost basis of all coins currently in circulation. When price stays above it, most holders are sitting on profit, which usually supports confidence, holding behavior, and slower sell pressure.

But once XRP fell under that level, the message changed. It suggests that a large portion of holders are now in an unrealized loss, and that’s the kind of shift that can quickly feed fear. When people start feeling “underwater,” the market becomes more fragile, because even small bounces can turn into exit opportunities.

This on-chain break is a key transition point

According to Alphractal, this realized price break is not just a random dip. It’s a major transition level that often separates bullish phases from more prolonged bearish cycles. Bulls attempted to defend the zone, but the fact that it failed, and failed cleanly, adds weight to the idea that XRP could be moving into a deeper bearish regime.

That doesn’t guarantee a straight-line collapse, of course. Crypto rarely moves that neatly. But structurally, when a market loses its realized price, it tends to shift from “buy the dip” energy into “sell the rally” behavior, and that’s a very different environment.

On-chain metrics are flashing more risk signals

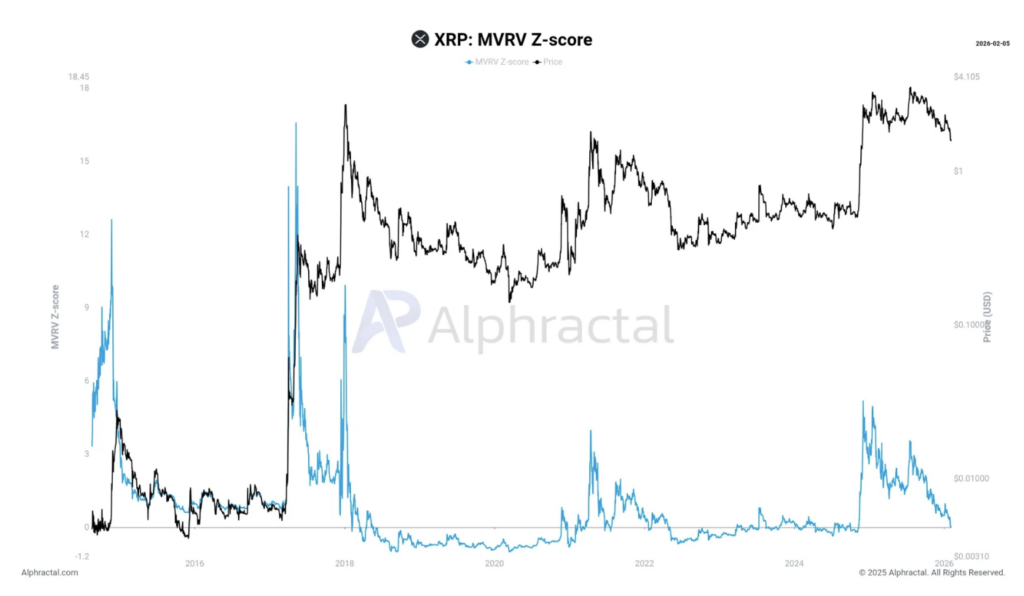

Other on-chain indicators are also leaning bearish. The MVRV Z-Score is sitting at a level that has historically acted as a dividing line between bear market continuation and short-term support. In past cycles, this zone often decided whether price could stabilize, or whether it would keep bleeding lower.

NUPL (Net Unrealized Profit and Loss) is also hovering near its transition line, which adds to the uncertainty. Meanwhile, the Realized Cap Impulse suggests capital is flowing out of the network, a sign that demand is weakening rather than strengthening. If this trend continues, more XRP activity could shift into the red, and that’s when selling pressure tends to get more aggressive.

It’s not just one metric saying the same thing either. It’s several signals lining up, and that’s what makes the setup feel heavier.

Weekly chart confirms XRP is in a corrective downtrend

From a technical perspective, TradingView analysis shows XRP is now in a corrective downtrend on the weekly chart. After the breakout in early 2025, XRP spent time distributing between roughly $2.30 and $3.30, but eventually the rally lost momentum. Now, with price sitting near $1.25, XRP is far below the mid-range of that previous zone, which strongly suggests the earlier bullish structure has failed.

Median band analysis also reinforces this. XRP is trading below both the central and lower volatility bands, which typically reflects sustained bearish momentum rather than a healthy pullback. Trendoscope indicators reportedly show weak activity in any run-up phase, while pullback bars dominate, implying that recent short-term rallies are more likely corrective bounces than real trend reversals.

Key levels traders are watching next

For XRP, resistance now sits around $1.70 to $1.85, a zone that would likely attract sellers if price attempts a rebound. On the downside, support is clustered near $1.00 and $0.95, and those levels are critical. If XRP loses them, the market could shift into a much harsher phase where panic selling becomes more common, especially with so many holders already sitting in unrealized losses.

Right now, the realized price breakdown has tilted the odds toward the bears. Bulls still have a chance, but they’ll need more than a bounce, they’ll need a real reclaim of key levels, and soon.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

3 hours ago

9

3 hours ago

9

English (US) ·

English (US) ·